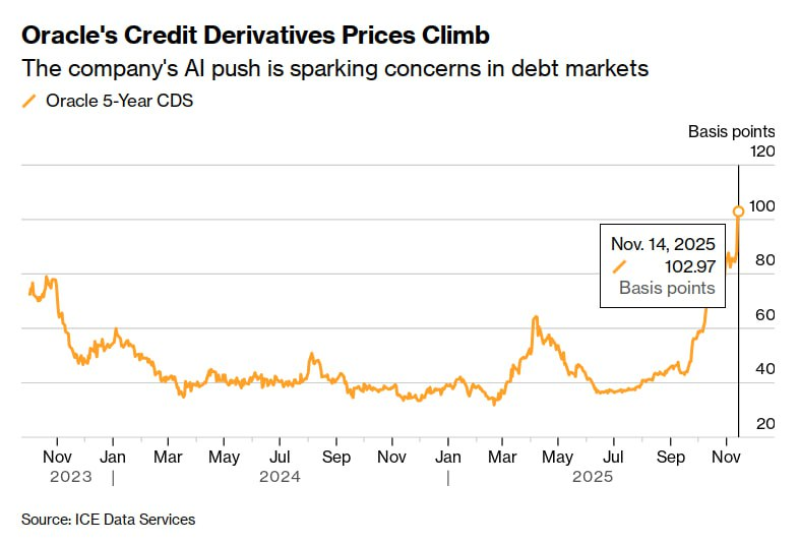

Oracle's aggressive push into artificial intelligence is raising red flags in debt markets. As the tech giant pours billions into AI infrastructure, credit default swap prices have surged to levels not seen since early 2023, suggesting investors are getting nervous about whether the company's spending spree is financially sustainable.

CDS spreads hit 102 basis points amid AI spending surge

The latest market data shows a dramatic shift in how investors view Oracle's financial risk.

The company's 5-year credit default swaps hit 102.97 basis points on November 14, 2025, signaling growing nervousness about whether Oracle's massive AI spending spree is sustainable or just a risky bet that could backfire.

From stability to sharp climb in 2025

For most of 2023 and 2024, Oracle's CDS stayed relatively stable, hovering between 20 and 55 basis points. But something changed in 2025. The spreads started climbing steadily through the year, and by late summer, they shot up dramatically. By November, they'd more than doubled, breaking past 100 basis points for the first time since early 2023. This means investors now want significantly more compensation to insure Oracle's debt.

Heavy capital spending on AI infrastructure

What's driving this? Oracle's been pouring money into AI infrastructure—building out cloud capacity, expanding data centers, buying specialized chips, and investing in high-performance computing. These aren't small expenses, and the market's starting to worry about what all this spending means for Oracle's debt levels and cash flow down the road.

The high-stakes question facing investors

Oracle isn't in trouble yet, but the speed of this CDS spike shows that investors are reassessing the company's medium-term financial risk. The big question everyone's asking: is Oracle stretching itself too thin financially, or is it getting ahead of competitors in what could be the next major tech wave?

If Oracle's AI strategy pays off and starts generating serious enterprise revenue, these elevated spreads might just be a temporary blip. But if revenue growth can't keep up with how fast the company's burning through capital, Oracle could face higher borrowing costs and tighter credit conditions ahead.

Right now, Oracle's CDS spreads are becoming a key indicator of how the debt market sees this high-stakes gamble. Will the AI spending bet strengthen Oracle's position—or put too much pressure on its balance sheet? The market's watching closely.

Usman Salis

Usman Salis

Usman Salis

Usman Salis