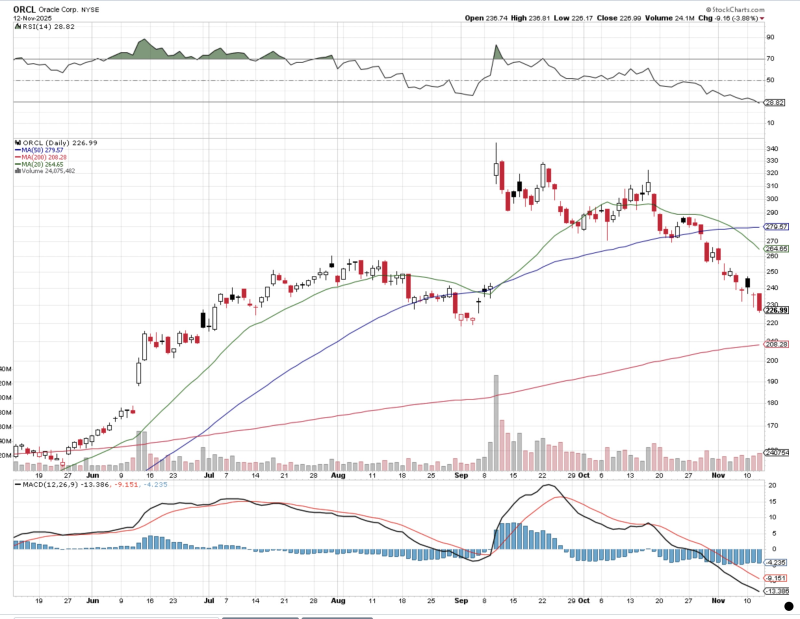

⬤ Oracle's stock (ORCL) is showing extreme momentum weakness, with its daily RSI now at the lowest level since April. Trading around $226.99, the stock has faced persistent selling pressure, catching traders' attention as they watch for potential oversold rebound signals. The decline has pushed Oracle into the spotlight as technical indicators hit multi-month lows.

⬤ Beyond immediate technical concerns, Oracle faces broader uncertainties from potential policy changes affecting the tech sector. Proposed tax reforms targeting capital gains, corporate earnings, and stock-based compensation could hit software and cloud companies hard. These changes might squeeze operational budgets, limit reinvestment, and push smaller tech firms toward financial trouble. Higher taxes on equity compensation could also trigger talent migration, with engineers and specialists moving to more tax-friendly regions—a real problem for Oracle as it competes in cloud and AI services.

⬤ Technical analysts are noting key support levels. One trader observed that ORCL's daily RSI is at its lowest since April and suggested the stock is "due for an oversold bounce, if just a bounce." Another analyst pointed out that it would be ideal for ORCL to touch its 200-day moving average and use it as support, indicating growing interest in this critical technical zone.

⬤ With RSI deeply oversold and price moving toward the 200-day average, traders are monitoring for stabilization signs. While tax policy uncertainty hangs over enterprise tech, the technical picture suggests Oracle might be approaching historically supportive levels. Whether this leads to a real recovery or just a temporary bounce remains to be seen, but ORCL is clearly on traders' radar right now.

Peter Smith

Peter Smith

Peter Smith

Peter Smith