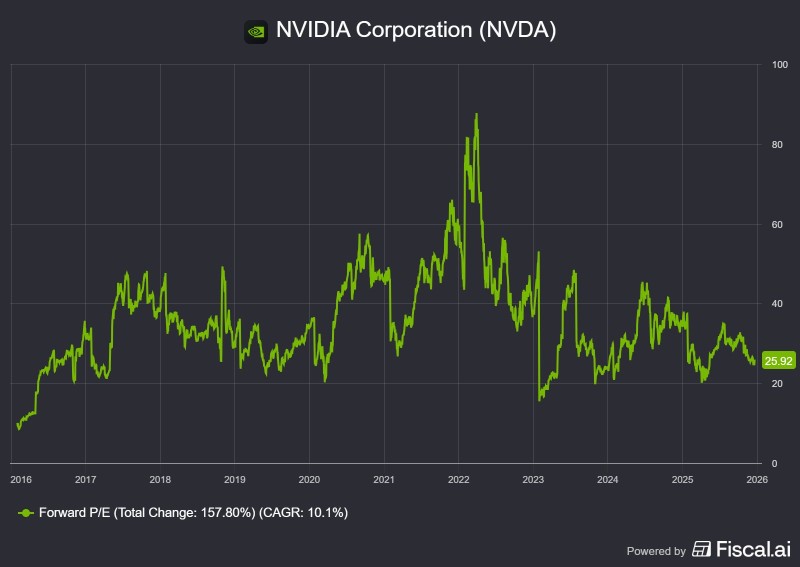

⬤ Nvidia is catching fresh investor attention as its stock trades around 25x forward earnings alongside a projected 58% two-year EPS growth rate. The valuation sits well below historical peaks from previous growth cycles, even as the company posts some of the strongest profitability numbers in the market. The current multiple reflects earnings expansion outpacing share price gains rather than speculative premium.

⬤ The chipmaker is running a 56% net margin with a 161% return on invested capital, positioning it among the most profitable large-cap companies globally. With roughly $50 billion in net cash on the balance sheet, Nvidia's financial foundation remains solid. These figures exclude any chip sales to China, meaning current earnings power stems entirely from demand in other markets.

⬤ Nvidia's forward P/E compressed sharply from 2021-2022 highs as earnings grew faster than stock appreciation. The current valuation near 25x represents normalization rather than expansion. If the company hits projected cash flow targets, it would lead the entire market in free cash flow generation—a metric that directly supports capital returns and reinvestment capacity.

⬤ The stock matters beyond its own performance because Nvidia has become a bellwether for AI infrastructure, semiconductor demand, and tech sector momentum. Its combination of high growth, exceptional margins, and reasonable valuation influences sentiment across technology investing. As global chip dynamics shift, how Nvidia balances profitability with cash generation could shape broader market expectations for the entire sector.

Usman Salis

Usman Salis

Usman Salis

Usman Salis