NVIDIA (NVDA) faces potential downside as market insiders reportedly cash out ahead of earnings, setting up retail investors for a possible 10-12 week market cooldown.

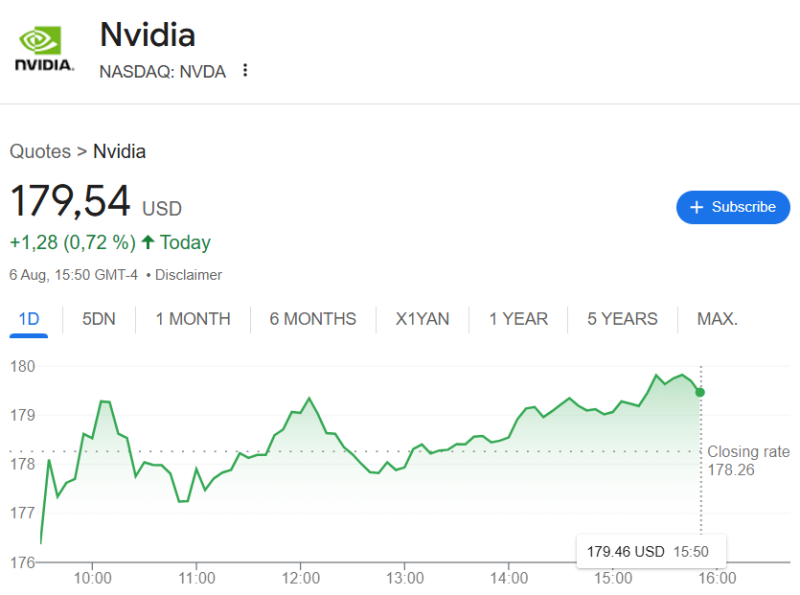

NVDA Price Becomes Market's Make-or-Break Moment

Market analysts are getting nervous about a potential sell-off, with NVIDIA's upcoming earnings looking like the final catalyst everyone's waiting for. A viral social media post captured what many traders are thinking: "Large sell-off can come. All insiders now have had a chance to get out. You are providing exit liquidity. Once $NVDA earnings over, there's no reason for this market to live. For another 10–12 weeks."

The message hits on something real - if smart money has been quietly heading for the exits while retail investors pile in, we could be setting up for a classic reversal once the earnings hype dies down.

Why NVDA Earnings Matter So Much Right Now

NVIDIA has basically become the poster child for this entire AI-driven rally. When NVDA moves, everything else follows - semiconductors, big tech, even the broader market. But here's the thing: expectations are already through the roof. If the company doesn't absolutely crush estimates, it could trigger some serious profit-taking across the board.

The worry isn't just about one company missing numbers. It's that recent gains might be built more on hype and FOMO than actual sustainable growth. And if institutional players have been quietly selling while everyone else buys the dip, retail folks could get caught holding the bag.

Could We Really See 10-12 Weeks of Pain?

The timing makes sense from a seasonal perspective. Late summer and early fall often see thinner trading volumes and choppier markets, especially when there aren't major catalysts keeping things moving higher. Once NVDA reports and that's out of the way, what's left to drive momentum?

Here's what to watch for:

- How NVDA actually performs versus those sky-high expectations

- Any unusual trading activity before and after earnings

- Whether tech stocks start moving independently or keep following NVDA's lead

Conclusion

NVIDIA's next earnings report isn't just another quarterly update - it might determine whether this rally has legs or if we're about to see a reality check. With insiders reportedly done selling and retail investors still buying, the setup feels risky.

Whether it's a full correction or just a summer slowdown, the smart money seems to think the party's almost over. And NVDA might just be the one to turn off the music.

Peter Smith

Peter Smith

Peter Smith

Peter Smith