Nvidia (NVDA) has staged a remarkable comeback after experiencing one of its steepest declines in recent history. The company lost nearly $600 billion in market value during what became known as the "DeepSeek moment," but the latest price action suggests those fears were largely exaggerated. The stock's resilience demonstrates that Nvidia's position in AI infrastructure remains as strong as ever.

The DeepSeek Panic and Market Overreaction

Industry analyst Daniel Newman noted how Nvidia shares crashed 17% in a single session when DeepSeek news hit the market.

The prevailing story was that Nvidia's infrastructure advantage was crumbling and that the GPU-driven AI boom might be ending. That panic now appears to have been an overreaction.

Nvidia's core business has stayed solid, driven by ongoing demand for GPUs across data centers, AI training platforms, and enterprise applications. The swift recovery visible in current charts shows that investors quickly realized the selloff was driven by emotion rather than any genuine deterioration in the company's prospects.

Chart Analysis: Price Zones and Market Sentiment

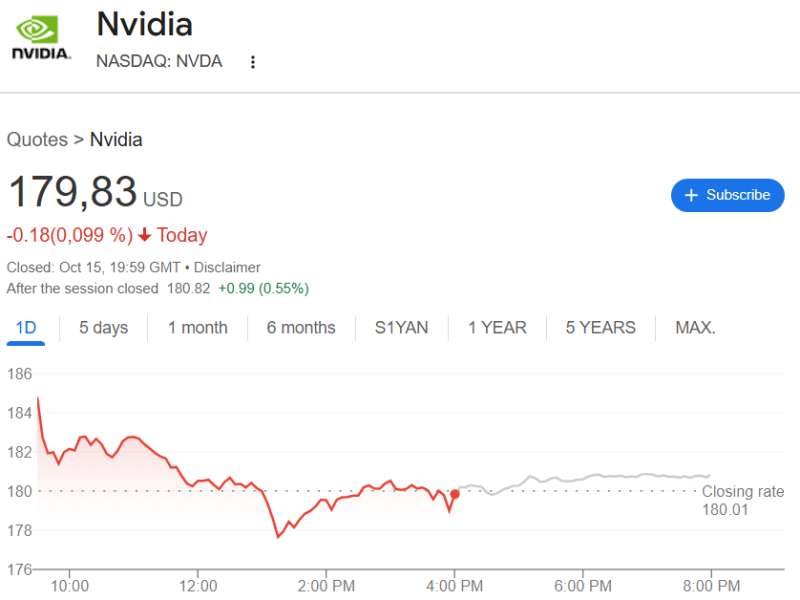

The technical picture reveals how Nvidia dropped toward $400 during the panic before finding its footing. This area provided strong support and attracted buyers, with the stock since forming higher lows - a positive technical development. Resistance sits around $500–$520, where previous rallies stalled, and a clean break above this zone could set up a move back toward $600. Meanwhile, $450 has emerged as critical support for maintaining bullish momentum, with any break below potentially triggering renewed selling. Trading volume during the crash was exceptionally heavy, typical of panic-driven liquidation, while the recovery has been marked by steady buying.

Why Nvidia's Growth Story Continues

The rebound isn't happening in a vacuum. AI demand from hyperscalers and enterprises keeps expanding, maintaining pressure on GPU supply. Nvidia's CUDA software platform creates deep customer relationships that go far beyond hardware sales. And despite market volatility, the company continues posting strong earnings with optimistic forward guidance.

Usman Salis

Usman Salis

Usman Salis

Usman Salis