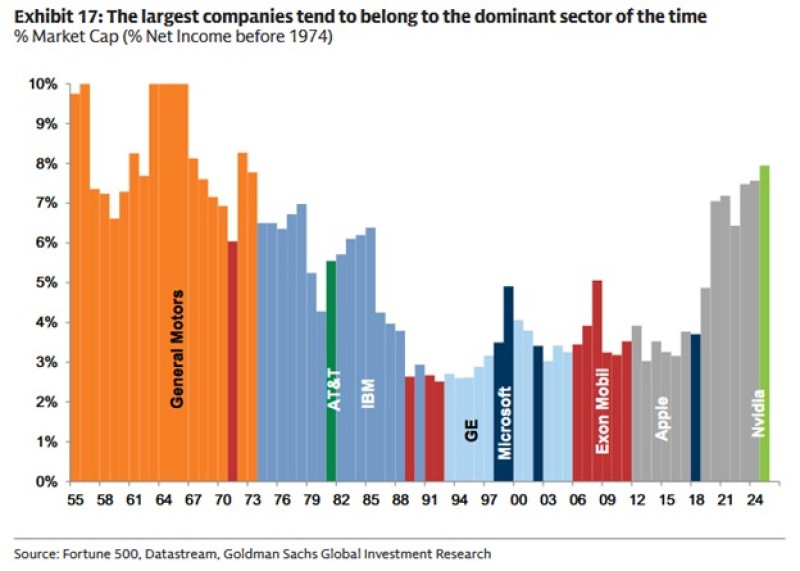

The title of most dominant company in the S&P 500 has shifted across industries for decades - from automakers and telecom to tech leaders. In 2025, Nvidia has claimed that position, now representing 8% of the index's total market cap. This marks the highest concentration by a single stock since the mid-1970s and ends Apple's six-year reign at the top.

Nvidia's Historic Market Position

According to The Kobeissi Letter and Goldman Sachs Global Investment Research, Nvidia's market share puts it in rare company.

Throughout market history, only a handful of companies have achieved this level of dominance:

- General Motors (1950s–1970s): Dominated for 18 years during America's industrial boom

- IBM (1970s–1980s): Controlled the market for 15 years during the computing revolution

- Microsoft and ExxonMobil (1990s–2000s): Led through the dot-com era and energy surge

- Apple (2010s–2020s): Held the crown for over a decade riding the smartphone wave

- Nvidia (2025): Now sits at the top, powered by surging demand for AI chips

Why Nvidia Leads Today

Nvidia's rise stems directly from its dominance in artificial intelligence and data center hardware. As AI adoption accelerates across cloud computing, autonomous systems, and enterprise applications, Nvidia's GPUs have become essential infrastructure for training advanced AI models. The company's explosive revenue growth and profitability haven't just made it a sector leader - they've made it the defining stock of this market cycle.

Market Weight Shifts Over Time

Historical patterns show the largest S&P 500 companies typically belong to their era's dominant sector. Industrials like GM led the postwar boom, telecom and computing giants like AT&T and IBM took over in the 1980s, technology and energy names like Microsoft and ExxonMobil alternated in the 2000s, and consumer tech through Apple reigned during the smartphone revolution. Today, AI hardware through Nvidia has become the market's defining force. With Nvidia now at 8% of the index, its position signals just how central AI has become to the current economic narrative.

Can Nvidia Hold Its Position?

The durability of Nvidia's dominance remains the key question. On one hand, AI infrastructure spending by governments and corporations is just beginning, with billions being deployed that could keep Nvidia on top for years. On the other hand, rising competition from AMD, Intel, and custom chips built by major cloud providers may pressure margins, while regulatory concerns about market concentration could eventually surface.

Peter Smith

Peter Smith

Peter Smith

Peter Smith