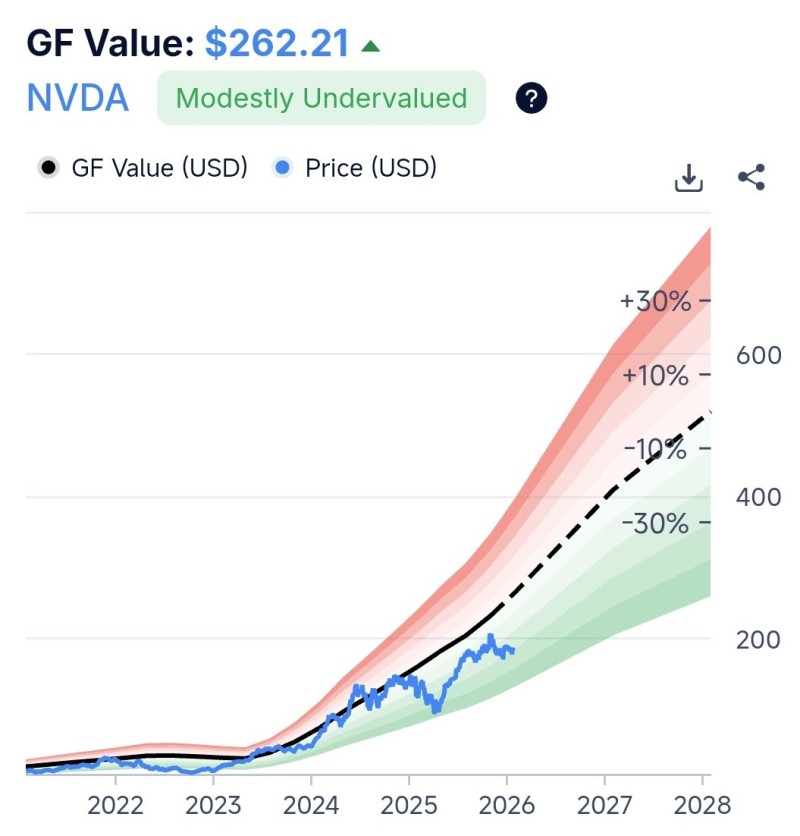

⬤ NVDA shares are catching investor interest after GuruFocus data revealed the stock is trading well below its calculated intrinsic value. Nvidia is currently priced around $187, while the valuation model assigns it a fair value of $262.21—a gap of roughly $75 per share. The chart positioning places the stock in modestly undervalued territory.

⬤ GuruFocus calculates fair value by combining historical valuation multiples, past business performance, and analyst projections. The visual shows Nvidia's price sitting within the green band below the dashed fair value line, suggesting the market hasn't yet caught up with the model's assessment. The shaded zones around the center line represent potential valuation ranges over different timeframes.

⬤ Even after massive gains over the past two years, Nvidia hasn't converged with its estimated fair value according to this model. The gap between current price and the GF Value line suggests there might be room for further appreciation if the stock moves toward its calculated intrinsic worth.

⬤ This matters because Nvidia carries enormous weight in major stock indices and the tech sector overall. How NVDA trades relative to valuation benchmarks can influence broader market sentiment. Whether the stock closes this $75 gap or stays below fair value estimates could shape expectations for high-growth tech stocks in coming months.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets