In a watershed moment for U.S. markets, Nvidia has reached an 8.2% weighting in the S&P 500 — the largest share any single company has ever held in the index's 65-year history. This unprecedented concentration shows just how much power one company now wields over the broader market's performance.

Nvidia's Unprecedented Sway Over the S&P 500

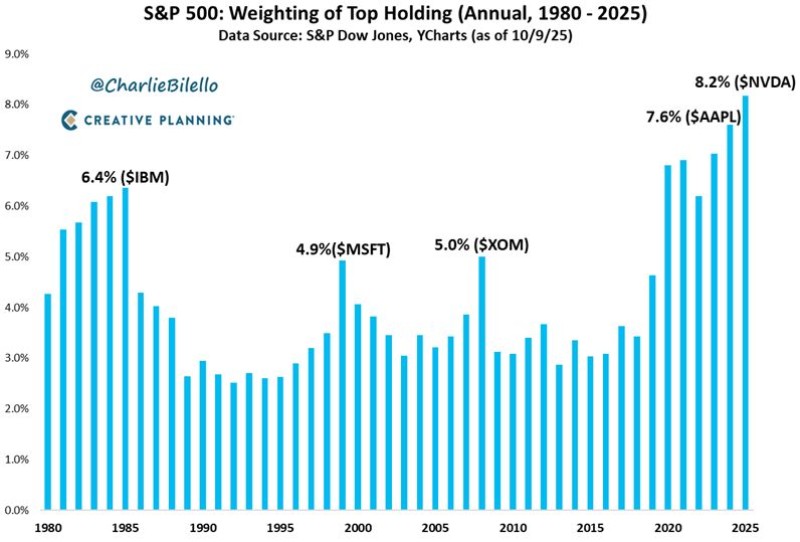

Data shared by trader Peter Mallouk reveals the dramatic shift taking place in market structure. A historical chart tracking top S&P 500 holdings from 1980 to 2025 tells the story clearly.

Previous market leaders included IBM at 6.4% in the 1980s, Microsoft at 4.9% around 2000, and ExxonMobil at 5.0% in 2008. Even Apple's 7.6% peak during the 2020s has been surpassed. Yet none of these giants came close to Nvidia's current dominance.

From Balanced Market to Single-Stock Concentration

The evolution is striking. Back in the 1980s and 1990s, the S&P 500 maintained relatively balanced weightings, with top holdings rarely breaking the 5% barrier. That era is long gone. The rise of mega-cap tech companies has fundamentally changed the game. Nvidia's explosive growth — driven by the AI revolution, soaring GPU demand, and its stranglehold on data center infrastructure — has reshaped the entire index. Today, nearly one-twelfth of the S&P 500's daily moves are tied directly to Nvidia's stock price. This creates a double-edged sword: while Nvidia's rally has lifted the whole index, any sharp decline could drag everything down with it.

What's Driving Nvidia's Rise

Nvidia has become the backbone of the AI revolution. Its chips power everything from generative AI models to enterprise data centers and supercomputing applications, creating a revenue engine that keeps accelerating. Meanwhile, former leaders like Apple, Microsoft, and Alphabet face slower growth and increasing regulatory headwinds, giving Nvidia room to consolidate its lead. The company's dominance reflects not just its own success but a broader market shift where passive investment flows and technology-driven growth keep strengthening the same handful of winners.

What This Means for Investors

Nvidia's rise tells a story of innovation and economic transformation, but it also raises red flags about market stability. The more concentrated the index becomes, the more vulnerable it is to a single stock's swings. For investors relying on broad index funds for diversification, this reality means those funds are less diversified than they were decades ago. That said, Nvidia's position captures something fundamental about our current moment — an era where AI infrastructure, not oil or legacy software, commands the largest stake in America's benchmark index. Whether this lasts or eventually rebalances depends on how Nvidia handles competition, regulation, and the next chapter of the AI boom.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov