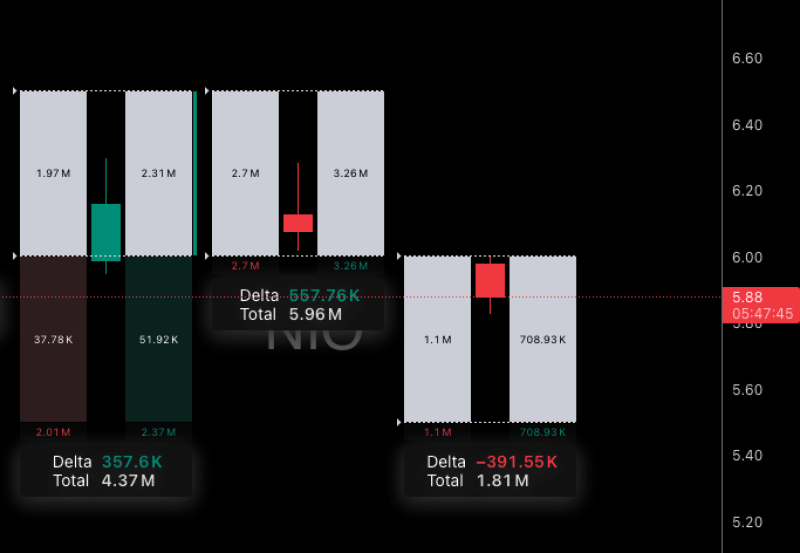

⬤ NIO stock remains stuck at extremely low prices in the $5 to $6 range, but something interesting is happening beneath the surface. The last two trading sessions showed distinctly positive delta, meaning buyers are finally starting to step in despite the ongoing pressure. Volume has also picked up noticeably compared to previous sessions.

⬤ Order-flow charts show a strong cluster of green volume bars and several positive delta spikes, confirming that buy orders are now outpacing sell pressure. The heatmap reveals consistent accumulation patterns across multiple sessions, with higher buy volume appearing even while the price stays compressed. Traders seem to be quietly building positions at these levels.

⬤ Intraday delta distribution points to periods of aggressive buying—the kind of behavior you typically see during early accumulation after extended declines. NIO has started stabilizing above its recent lows, backed by improving order-flow momentum. The combination of rock-bottom prices, positive delta, and rising volume marks a meaningful short-term shift.

⬤ Why does this matter? Accumulation at depressed prices often comes before stronger recoveries in volatile growth stocks like NIO. If buy-side participation keeps building and the broader market stays supportive, the stock could shift from a downtrend into a base-building phase. Current order-flow readings suggest growing interest in NIO at these valuation levels, hinting at a possible sentiment change ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis