NIO has caught traders' attention again after its strong 2025 rebound. The electric vehicle stock broke out of its long downtrend earlier this year but is now pulling back in what appears to be a healthy correction. This dip might give investors another shot at joining the rally before the next move up.

Technical Picture

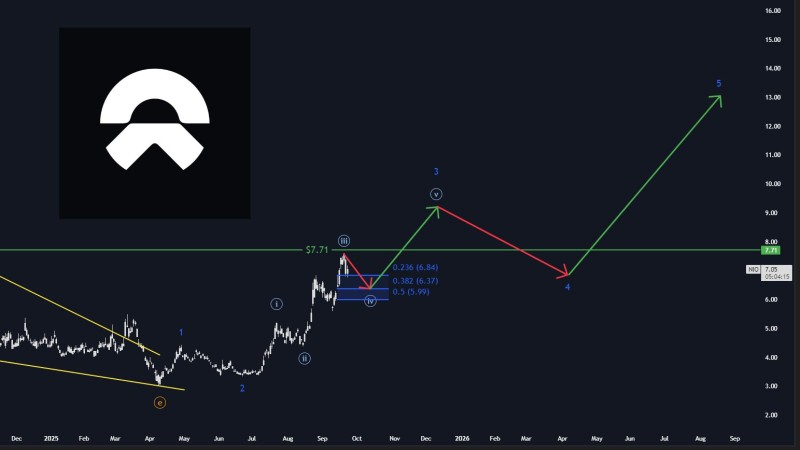

The charts show NIO moving through what looks like a classic Elliott Wave correction pattern. Using Fibonacci levels, analysts have identified a potential buying zone between $6.84 and $5.99 that could act as a launching pad for the next rally phase.

Key levels to watch:

- Support: $6.84–$5.99 (prime accumulation zone)

- Resistance: $7.71 (previous test level, breakout trigger)

- Target: $13+ (wave 5 projection and long-term resistance)

The technical setup looks bullish as long as NIO can hold above the $6 area. A bounce from the support zone could spark a breakout above $7.71 and open the door to much higher prices.

What's Driving the Bulls

The technical picture gets extra support from some solid fundamentals. Nomura just bumped up their price target for NIO, while Bank of America has issued several upgrades this month alone. China's aggressive push for EV adoption continues to create favorable conditions for companies like NIO, and the company's recent delivery numbers have been showing steady improvement, which keeps investor confidence intact.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah