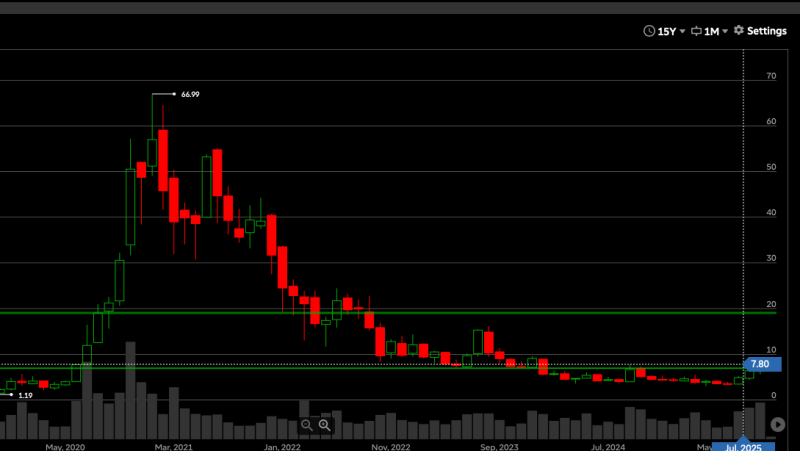

NIO is trading near $7.80 again - a price level that hasn't been seen in years and one that carries serious historical significance. The last time shares sat at this level, they launched into a seven-month rally that peaked at $66.99. Now that the stock has circled back to this zone after a brutal decline, investors are watching closely to see if lightning can strike twice.

Chart Analysis: What the Setup Looks Like

The monthly chart tells a wild story. After hitting bottom near $1.19 in 2020, NIO exploded to $66.99 by early 2021 - one of the most dramatic runs in EV stock history. Since then, it's been mostly downhill, giving back nearly all those gains. Now it's back where that rally started, sitting around $7.80. As trader The Real Denny pointed out, the price setup looks similar to 2020, but the environment surrounding it is completely different.

Support has held pretty consistently between $7.00 and $7.50. If buyers can push through resistance, the first real test comes around $12.00, with $20.00 further up the road. Volume has been quiet compared to the frenzy of 2020–21, which might suggest patient accumulation rather than hype-driven speculation.

Why This Price Level Matters

Whether NIO can mount another serious recovery depends on a few key factors. The global EV market is still growing, but competition in China is brutal - Tesla, BYD, and a swarm of local brands are all fighting for the same customers. Government policy could help if new subsidies or incentives come through, and at under $10, the stock looks cheap enough to attract contrarian buyers willing to bet on a turnaround.

But there are real headwinds too. Interest rates, slowing growth in China, and shaky consumer demand all cast doubt on how quickly things can improve.

What Comes Next

History doesn't repeat - it just rhymes sometimes. NIO's return to $7.80 brings back memories of its monster rally, but 2025 isn't 2020. If the stock holds support and breaks through resistance on stronger volume, momentum traders might jump back in. Without fresh catalysts though, expecting another seven-month rocket ride to $66.99 seems like wishful thinking.

Right now, NIO is a mixed bag. There's potential for a comeback if the fundamentals line up, but there's also a real chance it just stays stuck if sentiment and demand don't improve. It's a setup that offers both opportunity and risk in equal measure.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah