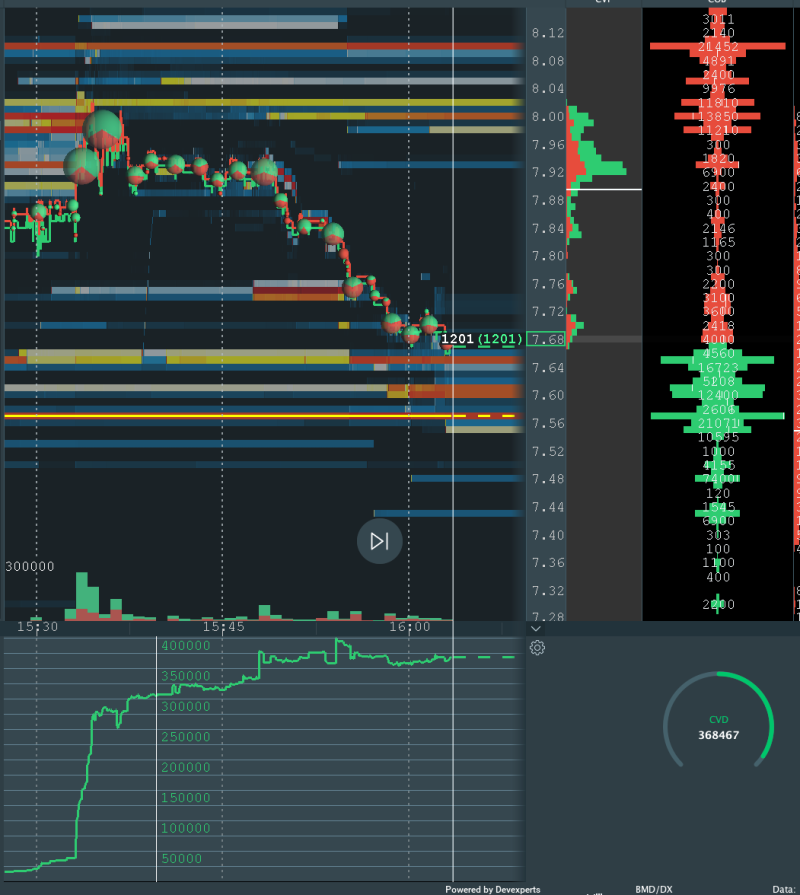

NIO has faced consistent selling pressure lately, but the underlying order flow reveals something different. The cumulative volume delta (CVD) stays firmly in positive territory, showing that buyers are steadily soaking up shares at important price points. Even though the stock has drifted lower during trading sessions, the way orders are stacking up suggests strength hiding beneath the surface rather than genuine weakness.

Liquidity and Market Flow

Trader Pax pointed out that NIO's current price movement tracks liquidity clusters pretty closely.

There's a noticeable concentration of buy orders sitting around $7.60–$7.65, creating what looks like a safety net against deeper drops. Sellers keep pushing, but demand keeps matching that pressure - which typically signals accumulation by stronger hands rather than nervous retail selling.

Chart Analysis

The heatmap shows a downward intraday drift with several waves of selling, but thick liquidity bands (those orange and yellow zones) appear right around $7.60 where buyers consistently step in. The CVD holding at 368,467 confirms net buying continues despite the price sliding. There's been no panic selling - most transactions get absorbed within these major liquidity zones. Resistance is visible near $8.00 where supply concentrations build up. If the bids keep holding firm at current levels, NIO might push back toward that $8.00 zone before long.

Market Context

What we're seeing in NIO's order flow mirrors the broader mood in the EV sector right now. Traders are playing it safe, but the liquidity data tells us that more experienced participants are quietly building positions. This kind of behavior often happens before a rebound takes shape.

Usman Salis

Usman Salis

Usman Salis

Usman Salis