NIO stock is caught in an intense intraday tug-of-war between buyers and sellers. Order book data reveals a fierce liquidity battle, with both sides fighting for control at key price levels. This technical standoff could determine NIO's next major move as the EV maker faces ongoing sector headwinds.

Order Book Reveals Liquidity Warfare

The trading action, described by Pax as a "war," shows a classic standoff where neither side is willing to back down.

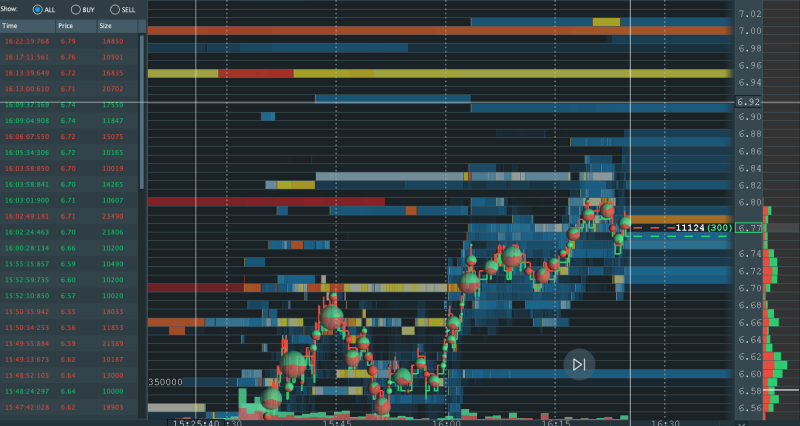

The heatmap shows a clear battleground:

- Heavy sell walls stacked between $6.75–$7.00, creating strong resistance

- Aggressive bid support clustered around $6.60–$6.65, preventing deeper selloffs

- Tight trading range forming as momentum builds toward a breakout

This concentrated liquidity on both sides creates a narrow corridor where neither bulls nor bears can gain lasting control. The sharp bounce from $6.55 to $6.77 shows buyers stepping in, but repeated rejections below $6.80 prove sellers aren't backing down.

What's at Stake

NIO continues facing pressure from slowing EV demand and intense competition in China. Yet the order book structure suggests traders are positioning for a decisive move. A break above $7.00 could open the door to $7.20–$7.50, while failure to clear resistance risks pushing the stock back below $6.50. For now, volatility is the only certainty as this technical battle plays out in real time.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah