NIO is making moves just before one of its most important reporting periods. With the Chinese EV market heating up and competition getting fiercer, investors are keeping a close eye on any signs that could hint at the company's direction. The timing couldn't be more crucial as delivery numbers and earnings are set to drop within days.

NIO Price Gains Momentum on HKSE

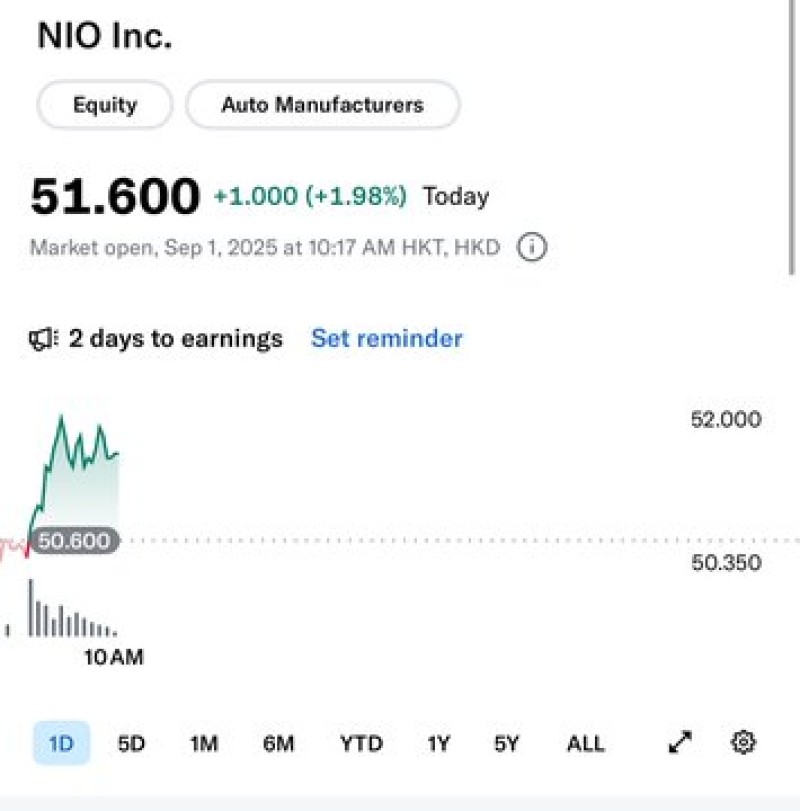

NIO shares on the Hong Kong Stock Exchange jumped to HK$51.60, up 1.98% during Monday's session. This uptick comes just two days before the company drops its earnings report - something investors have been eagerly waiting for as they try to figure out how NIO is holding up against tough competition in the EV space.

Well-known trader @TheValueTrade pointed out that the real action might happen once we see the delivery numbers. He mentioned that investors should "watch this tomorrow night after deliveries," suggesting these figures could make or break the current rally. Since delivery data has always been a major driver for the stock, traders are expecting some serious price swings.

NIO Price Outlook Before Earnings

- Current Price: HK$51.60 (+1.98%)

- Support Level: HK$50.00

- Resistance Zone: HK$52.00–HK$53.50

- Event Risk: Earnings report in 2 days

The chart shows NIO sitting comfortably above the HK$50 level. If it can push past HK$52, we might see it climb toward HK$55. But if the delivery numbers disappoint, it could easily slide back down to support levels.

Broader Context: EV Market Pressure

China's EV market is getting crazy competitive, with companies like BYD and XPeng going all-out to grab market share. Tesla's still a major player too, which keeps the pressure on for everyone else. Add in things like raw material costs, trade policies, and government support, and you've got a lot of moving parts that could affect NIO's results and future outlook.

With just two days until we get the delivery and earnings data, both traders and long-term investors are getting ready for some potentially big moves in NIO stock.

Peter Smith

Peter Smith

Peter Smith

Peter Smith