Chinese electric vehicle manufacturer NIO has caught traders' attention as technical indicators suggest a possible trend reversal. After months of decline, the stock appears to be forming a foundation for potential upward movement, with critical levels determining whether bulls or bears will control the narrative.

Intriguing Setup for NIO Price Action

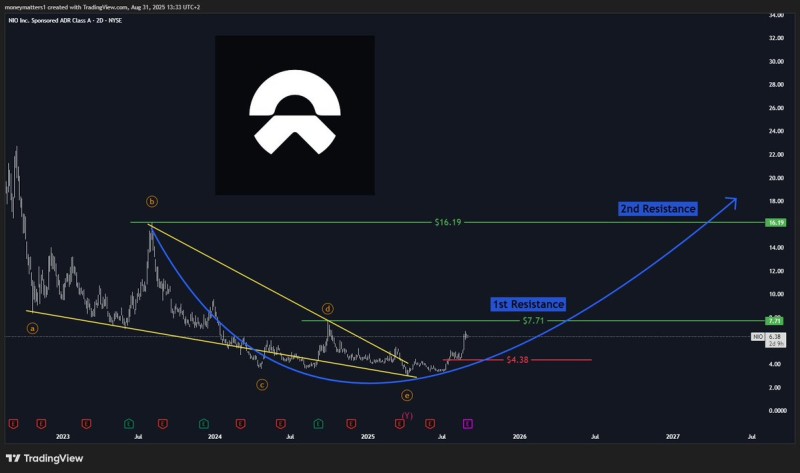

The EV market is gaining momentum again, putting NIO squarely in traders' crosshairs. Following an extended downtrend, the stock has developed what looks like a rounded bottom pattern—a classic signal that often precedes significant upward moves. The momentum is building toward a key target of $8.00, though the journey won't be smooth.

Market analyst @MMatters22596 highlighted that NIO's bullish potential hinges entirely on maintaining support above $4.38. Break below this critical level, and the optimistic outlook crumbles, potentially sending the stock to fresh lows.

The technical landscape presents clear battlegrounds:

- Support level: $4.38 (breaking this invalidates the bullish case)

- First resistance: $7.71 (clearing this opens the door to higher prices)

- Second resistance: $16.19 (longer-term upside target)

Trading around $6.38 currently, NIO offers an attractive risk-reward setup—assuming next Tuesday's earnings deliver positive surprises.

NIO Price Outlook: Bulls vs. Bears

Bullish scenario: Breaking above $7.71 could propel NIO toward $8-$10 quickly. Strong earnings would amplify this move, potentially setting up a run toward $16.19 over the medium term.

Bearish scenario: Falling below $4.38 destroys the bullish thesis and opens the path to new all-time lows.

With earnings due Tuesday, expect sharp price swings in both directions. The technical setup looks promising, but everything depends on NIO holding support levels and showing financial progress.

Peter Smith

Peter Smith

Peter Smith

Peter Smith