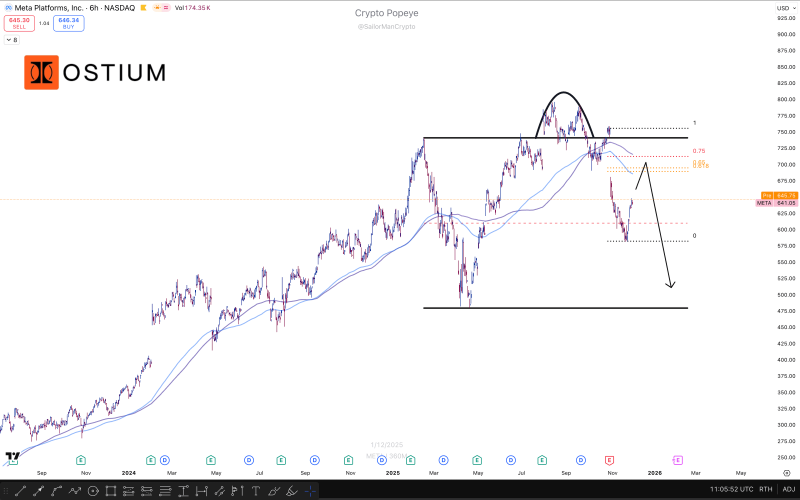

⬤ Meta's share price is softening again after it slipped back into the price band it has occupied for months. On the six hour chart the upward push has run out of steam. The stock nosed above the top of that band then turned down at once and now sits under the old peaks, a place that looks increasingly fragile.

⬤ The short term shape is negative. Traders are ready to sell short if the price revisits the main barrier overhead. That barrier is made up of three parts - the six hour trend line that has already snapped, the Fibonacci retracements at 0.75 and 0.618 and a small gap that still waits to be closed. The price has traced a gentle arc beneath the recent highs - that arc is a supply zone where sellers appeared last time.

⬤ Should the stock turn away from this thick layer of resistance, the next stop is the lower edge of the wide band it has held since last year. The price has lifted off its lows - yet it remains under the main trend gauges. The decisive moment will come when it returns to the Fibonacci zone. Either it punches through or it is repelled again - the outcome will set the tone for the weeks ahead.

⬤ The importance is that Meta now stands at a junction where the medium term path often changes. A failed retest will show the shares are still locked in the range and that momentum is ebbing. A clean break above the trend line would swing mood toward the upside. Traders are waiting to see which way the next test ends.

Usman Salis

Usman Salis

Usman Salis

Usman Salis