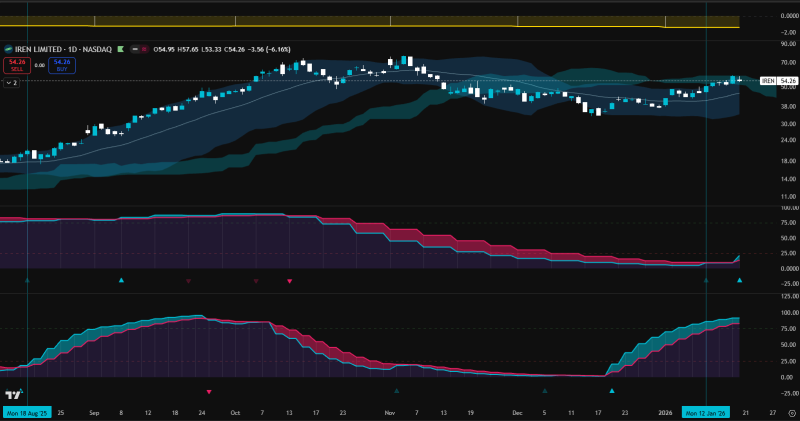

⬤ Iris Energy Limited (IREN) is starting to show early signs of a potential momentum shift after weeks of consolidation. The stock's trading near the mid-$50s following a pullback from recent highs, with price action stabilizing rather than accelerating. This suggests the market's trying to regain balance after its volatile advance earlier in the cycle.

⬤ One notable development on the chart is the upward turn in stochastic indicators. Both stochastic measures have started trending higher, signaling improving short-term momentum. Historically, a similar stochastic configuration preceded a significant upside move in IREN—when the stock surged from the $20 area toward the $70s. However, the current setup's different because price hasn't yet broken out of its broader consolidation structure.

⬤ Despite the improving momentum signals, IREN's still trading inside the Ichimoku cloud—a technical zone that typically signals uncertainty and overlapping supply and demand. While buying pressure's increasing, directional control hasn't been established yet. Price remains capped by nearby resistance levels, and recent candles show hesitation rather than strong follow-through, pointing to continued choppy movement ahead.

⬤ This phase matters because IREN has historically delivered strong directional moves once momentum indicators and price structure align. The combination of rising stochastic indicators and consolidation within the Ichimoku cloud points to a transition period rather than a confirmed trend. How price behaves around the cloud boundaries in the coming sessions may determine whether this momentum shift develops into a sustained move or stays limited to range-bound trading.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah