After multiple challenging quarters, Intel (INTC) is gradually working its way out of a prolonged earnings decline. The latest numbers reveal a mixed picture: losses are shrinking, but sales remain flat. The company has made progress on cost management, yet it's still fighting to reclaim market share in a semiconductor industry increasingly shaped by AI. While competitors post record results, Intel's trajectory looks more like stabilization than a genuine comeback.

Earnings and Revenue: Narrower Loss, Stagnant Sales

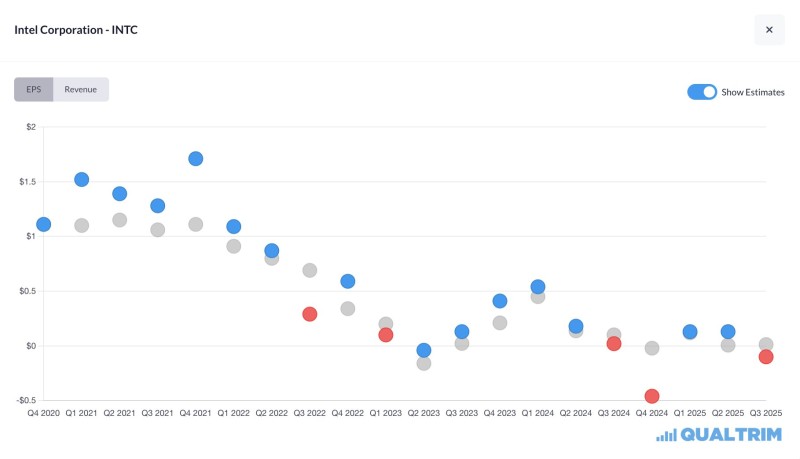

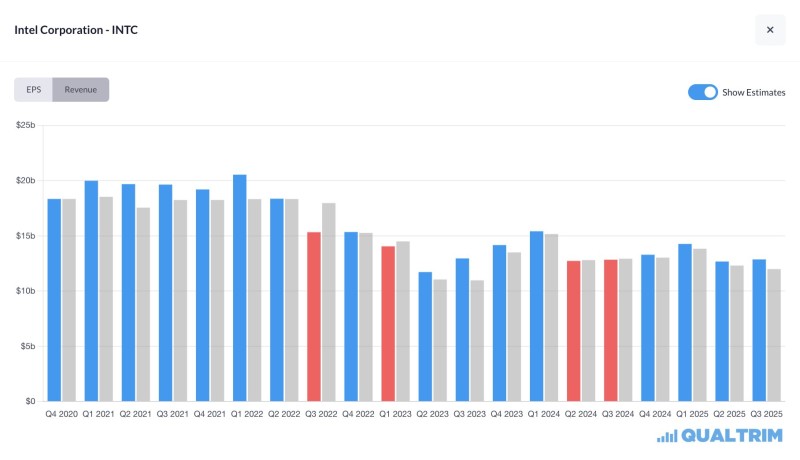

According to Qualtrim, Intel's earnings per share improved substantially to –$0.12 from –$0.63 year-over-year—the most significant loss reduction since mid-2022. Revenue, however, fell 1.3% to $13.11 billion, extending a years-long stagnation visible in the chart.

Since early 2021, quarterly revenue has dropped from peaks above $20 billion down to the $13–15 billion range.

The EPS trendline tells a similar story. Profitability has been sliding since 2021, when earnings regularly exceeded $1.00 per share.

The scatter chart shows lower highs and sharp declines through 2022–2023, with only modest stabilization expected into 2025. The next few quarters are projected near breakeven, suggesting that restructuring and foundry investments haven't yet delivered financial gains.

Industry Context and Strategic Challenges

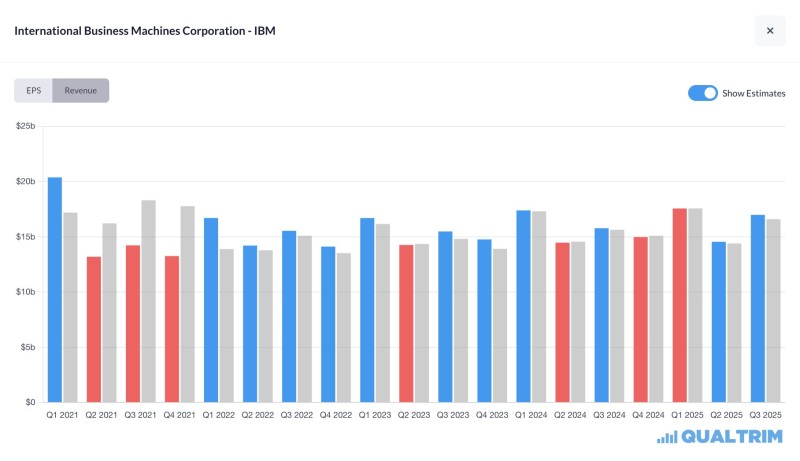

Intel's struggles coincide with a major shift toward AI chips and data center acceleration, markets dominated by NVIDIA and AMD. To catch up, Intel is betting heavily on its foundry strategy and U.S. manufacturing expansion—a long-term play that strengthens supply chains but hurts near-term profits. The accompanying IBM charts highlight this contrast: while Intel's results swing wildly, IBM's revenue has held steady between $15 billion and $20 billion since 2021 with consistent earnings. This gap explains why IBM attracts dividend-focused investors while Intel remains a higher-risk turnaround bet.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah