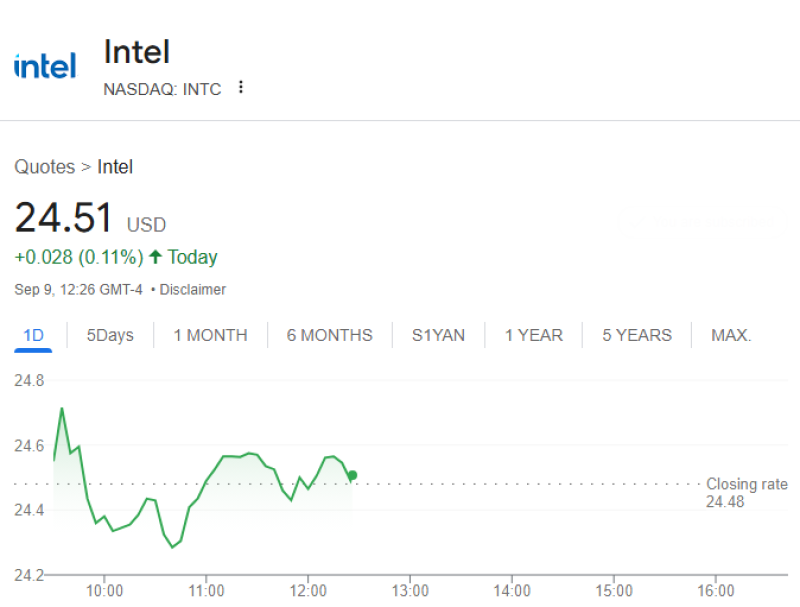

Intel's comeback attempt is probably the biggest story in chips right now. After getting beat up by competitors for years, they're trying to rebuild everything—manufacturing, AI chips, foundry business, you name it. But Truist Securities isn't buying the hype just yet. In a note highlighted by Hardik Shah, they're sticking with their Hold rating and $21 target, which puts the stock about 15% below today's $24.57 price.

What Analysts Are Seeing

Progress, but baby steps: Intel is definitely working on getting its act together. They're fixing operations, chasing AI money, and building partnerships. The culture is changing, and they're getting some government backing. But Truist says it's all happening way too slowly. The company has big plans, but actually pulling them off on schedule? That's where things get dicey.

The execution gamble: Here's the thing everyone's worried about—Intel talks a big game, but can they actually deliver? The company has missed targets before, and there's no guarantee this time will be different. Truist isn't changing their numbers until they see real proof that Intel can execute at the level they're promising.

Why This Matters

Intel is basically betting the farm on AI, foundry services, and next-gen chips. They need to win back customers who've been going elsewhere for years. Some early signs look decent, but this isn't a quick fix—it's a multi-year slog through a brutal competitive landscape.

Conclusion

Truist's message is simple: hold your horses. Intel is moving in the right direction, but it's going to take time and there are no guarantees. Until they start showing concrete wins—real customer deals, foundry breakthroughs, or actual margin improvements—the stock stays in neutral territory. Patience required.

Usman Salis

Usman Salis

Usman Salis

Usman Salis