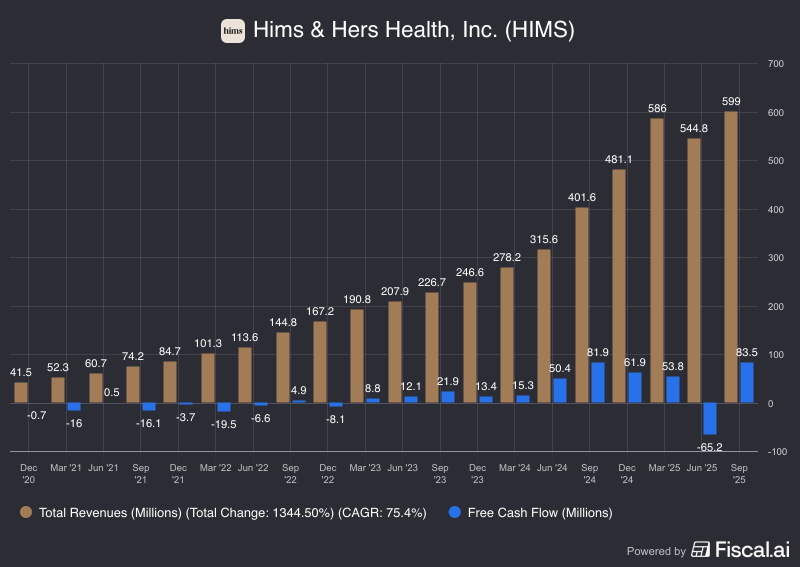

⬤ Hims & Hers Health raised its revenue from $41.5 million in late 2020 to about $599 million by September 2025, a rise above 1,300 %. Growth stayed steady through the whole period then accelerated sharply in 2024, when quarterly revenue passed $315 million in mid-year and exceeded $480 million at year end.

⬤ The company's cash flow improved even more. Free cash flow stayed negative through most of 2020-2022; some quarters lost more than $10 million. The trend reversed in 2023, when free cash flow reached $21.9 million in September. In 2024 the figure peaked close to $81.9 million, slipped briefly in mid-2025 then recovered to about $83.5 million by September.

The data shows why investors need to watch both revenue momentum and cash flow stability while companies move from early growth to full operational maturity.

⬤ Sharp revenue growth paired with stronger cash flow shows how fast a digital health firm can alter its financial profile. The figures indicate that HIMS has shifted from early stage expansion to a more mature operational phase, a change that may influence how investors judge the company across the consumer wellness sector.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah