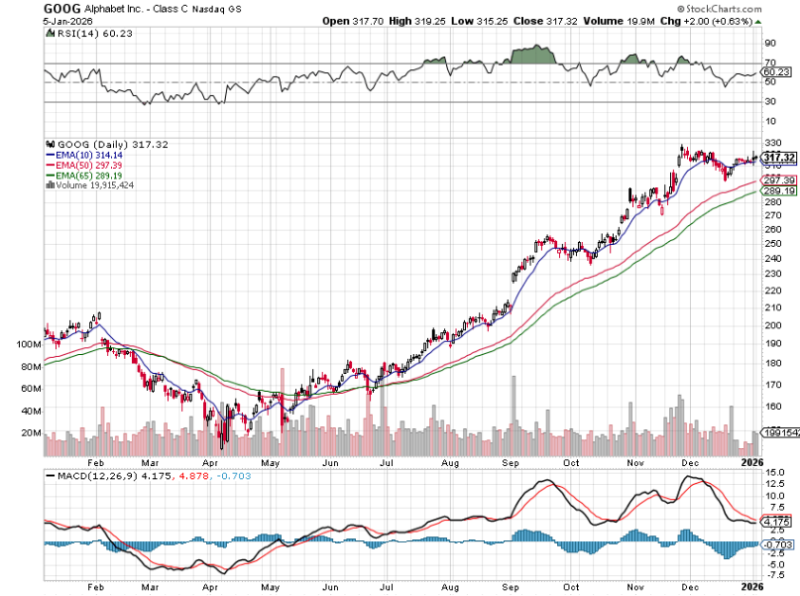

⬤ GOOG shares are consolidating near elevated levels after a strong multi-month run. Alphabet has kept its momentum rolling into early 2026, holding around the low $300s following a steady climb from mid-year lows. Trading activity in GOOG has stayed active, keeping traders focused on whether the stock can hold these gains.

⬤ The chart shows Alphabet locked in a clean uptrend, with rising short-term and intermediate moving averages providing support. GOOG continues trading above its 10-day and 50-day EMAs, both sloping higher and acting as dynamic floors. The stock also sits comfortably above its 65-day moving average, showing this trend has legs rather than cracks.

⬤ Momentum indicators show consolidation, not exhaustion. The RSI remains above the midpoint, meaning buyers still have the upper hand in this trend. Meanwhile, the MACD has started flattening after a strong expansion phase—a pause in momentum rather than a bearish turn. Volume has cooled compared to earlier breakout sessions, which fits a healthy digestion phase rather than aggressive selling.

⬤ This matters because Alphabet is a heavyweight in major indices and the tech sector. When GOOG holds up, it can lift broader market sentiment since large-cap leaders often set the tone. With Alphabet trading above rising moving averages and consolidating after a prolonged rally, the chart shows the market absorbing gains rather than reversing. How GOOG breaks out of this consolidation could signal where large-cap tech is headed next.

Peter Smith

Peter Smith

Peter Smith

Peter Smith