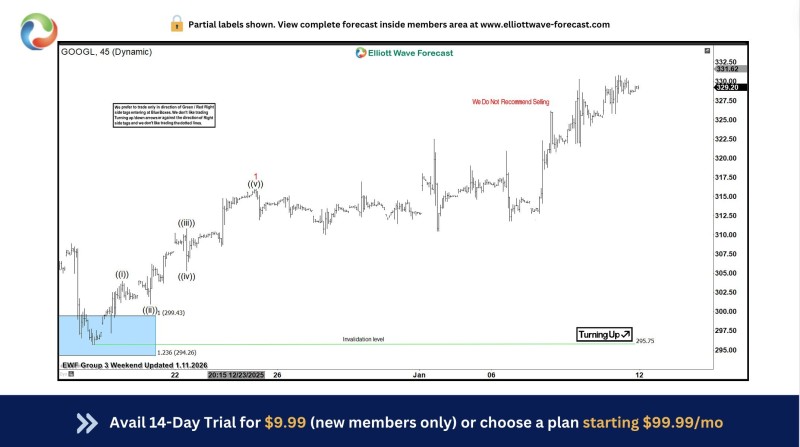

⬤ Alphabet Inc. (GOOGL) pushed higher after its recent dip found solid footing in a well-defined demand zone. The price bounced fast from this area—buyers didn't hesitate, stepping in aggressively and driving the stock up while keeping the broader bullish structure that's been building since late December fully intact.

⬤ The pullback hit the blue box zone marked on the one-hour chart, a level that typically signals corrective exhaustion in Elliott Wave terms. GOOGL reacted immediately, forming a clean swing higher without wasting time in consolidation. That's textbook behavior for a completed correction followed by trend resumption.

⬤ Throughout the rebound, price stayed comfortably above the invalidation level near mid-$295. Higher lows formed steadily, and the advance toward $330 unfolded in an orderly fashion—no wild volatility spikes, just structured buying. Selling pressure got absorbed efficiently, which tells you demand's still in control.

⬤ This move matters beyond GOOGL itself. As a heavyweight in large-cap tech indices, its ability to defend technical support and resume climbing suggests pullbacks are still drawing buyers rather than triggering sustained selling. As long as price holds above that key support zone, the structure points to continued stability within the current trend.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov