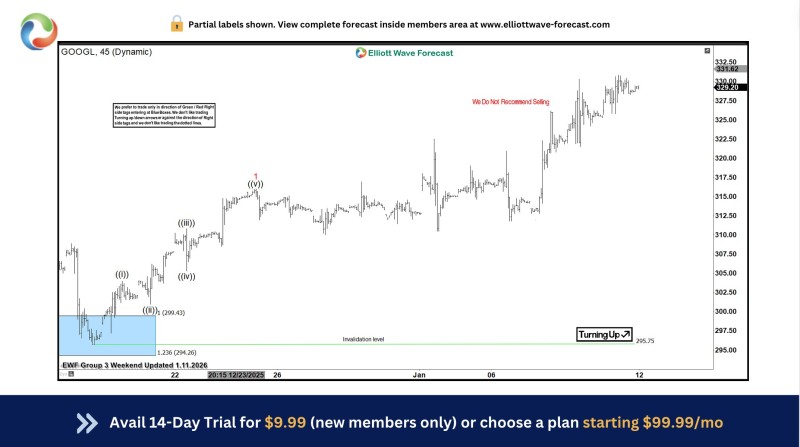

⬤ GOOGL started climbing again after a corrective dip brought it down to a key support area marked on the chart. The stock dropped into the blue box zone before steadying and reversing course, signaling a shift in short-term direction. The pullback delivered a clean response at support, and now an early move higher is taking shape.

⬤ The chart shows Google maintaining its broader uptrend even through recent consolidation. After pushing toward the low $330s, GOOGL entered a correction that pulled price back toward the $300 level. This decline played out in controlled fashion and found solid footing within the blue support zone, which lines up with Elliott Wave structure. The invalidation level sitting below this zone reinforces that the pullback was corrective—not a trend reversal.

⬤ Since bouncing off support, GOOGL has been forming higher lows and reclaiming resistance levels nearby. The rebound has been steady without wild swings, suggesting consistent buying rather than temporary spikes. Price action above the support zone shows selling pressure got absorbed, keeping the overall trend intact as the stock transitions back into upward mode.

⬤ This matters for the broader market given Google's weight in major U.S. indices and the tech sector. A solid bounce from well-defined support can reinforce confidence in the trend and stabilize sentiment short-term. The visible invalidation level also gives a clear reference point for risk if things change. Right now, GOOGL is showing constructive behavior, with the support bounce shaping expectations for continued trend alignment going forward.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi