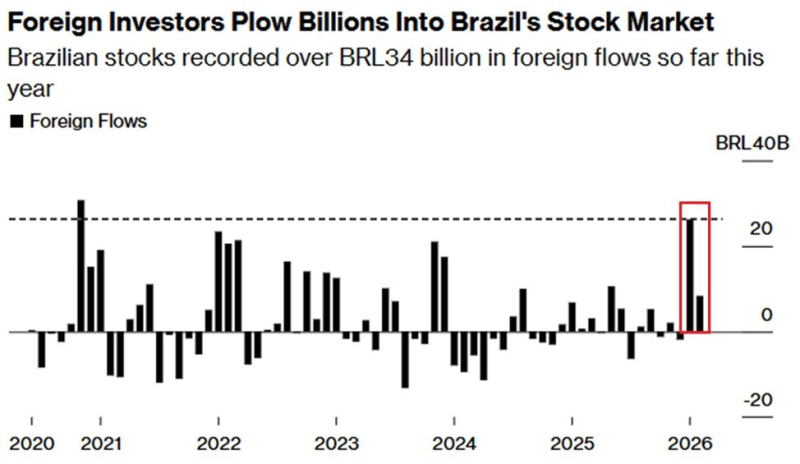

⬤ Brazil's stock market has become one of the hottest destinations for foreign money in 2026. As The Kobeissi Letter reported, Brazilian equities have already pulled in $6.6 billion in foreign inflows this year, blowing past the $4.9 billion recorded across all of 2025. Recent flow data shows inflow bars sitting well above historical averages, pointing to one of the strongest surges of outside capital the market has seen in years.

⬤ The money flowing in has brought trading activity with it. Average daily volume in Brazilian equities hit $6.1 billion last month, the highest reading since November 2022. That jump in market engagement lines up with a standout run for EWZ, the ETF that tracks roughly 85% of Brazil's listed stocks. EWZ climbed 17% in January alone, its best single-month performance since 2020, signaling serious renewed global appetite for Brazilian equity exposure.

Brazilian stocks have recorded $6.6 billion in foreign inflows so far in 2026, already exceeding the $4.9 billion recorded in all of 2025.

⬤ Macro conditions have played a real role here. A softening US dollar and rising commodity prices have tilted the playing field in favor of emerging market assets, and Brazil sits squarely in the sweet spot. Its equity market carries heavy weight in materials and energy, two sectors that tend to run hot when commodities climb. That mix has pushed international allocators to look beyond developed markets and lean into Brazil as a source of returns.

⬤ Together, the inflow numbers and EWZ's performance paint a clear picture: Brazil has moved from the margins to the center of the global equity conversation. Elevated volumes and sustained foreign buying reflect genuine investor confidence. Whether the run continues depends on how long the dollar stays soft, where commodity markets go from here, and whether broader risk sentiment holds up as investors keep weighing opportunities across regions.

Usman Salis

Usman Salis

Usman Salis

Usman Salis