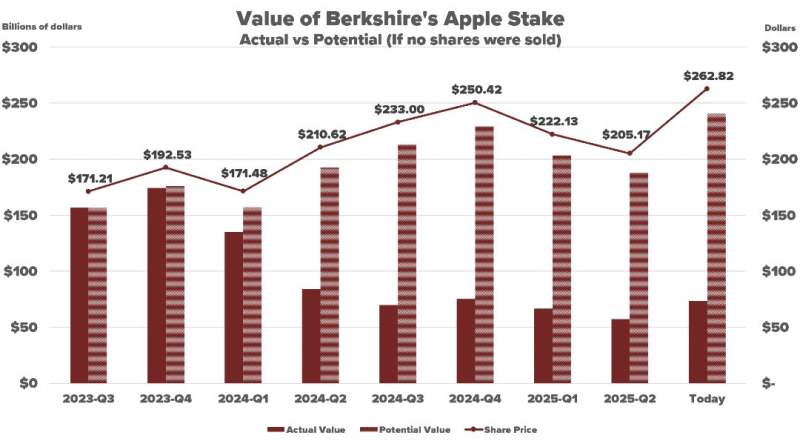

● Stock Sharks broke down just how much money Berkshire Hathaway left on the table by selling some of its Apple ($AAPL) shares. If Warren Buffett's company had never touched that position, it would be worth nearly $241 billion right now—a staggering number that really puts Apple's growth into perspective.

● The chart tells the story pretty clearly: Berkshire's actual Apple holdings have bounced around between $171 billion and $205 billion since 2023, but if they'd just held tight? That number would be pushing $262.8 billion today. It's a good reminder that even smart profit-taking comes with trade-offs—you lock in gains, sure, but you also cap your upside if the stock keeps climbing.

● And Apple definitely kept climbing. By taking some chips off the table, Buffett secured solid profits but also cut Berkshire's exposure to what's been one of the best-performing stocks in the portfolio. Those sales looked prudent at the time, but in hindsight, they cost Berkshire tens of billions in potential gains as Apple surged to fresh all-time highs.

● Still, let's not overstate things—Apple is still Berkshire's biggest bet by far. Even after the trimming, it makes up nearly half of the company's entire public stock portfolio. Apple's rock-solid earnings, its insanely loyal customer base, and that ecosystem moat have made it a core part of Buffett's strategy for the better part of a decade.

● As Stock Sharks put it: "If Berkshire never sold any of its Apple shares, their stake would be worth about $241 billion today." It's one of those stats that makes you think—even the greatest investor of all time has to wrestle with the tough call between playing it safe and letting winners run.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah