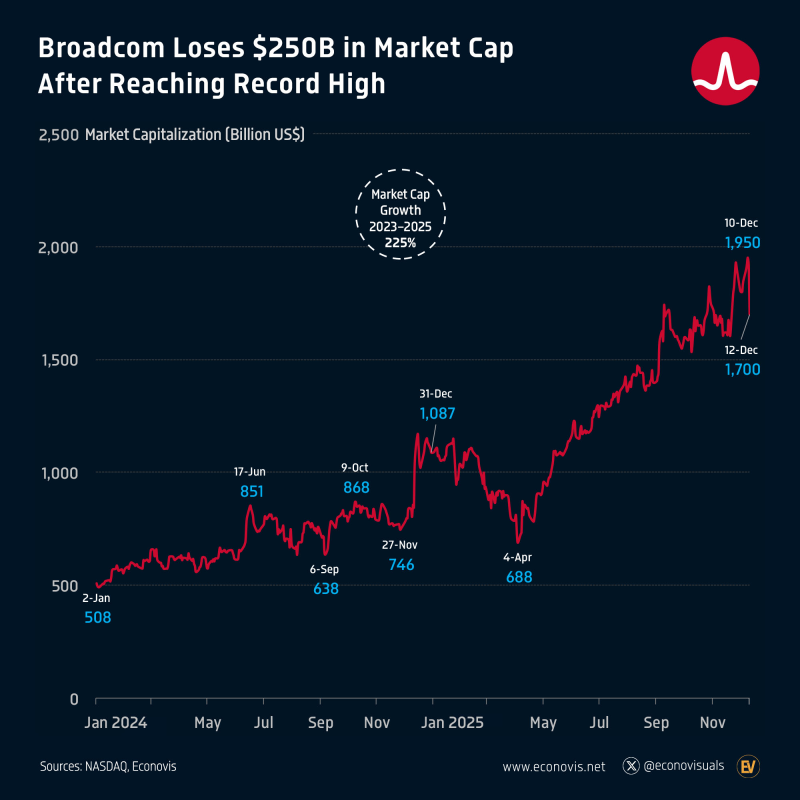

⬤ Broadcom's market value fell hard right after it touched an all time high in early December. The semiconductor company reached a peak of $1.95 trillion on 10 December 2025 then slid to about $1.70 trillion by 12 December. In two trading days it shed roughly $250 billion, equal to 12.8 %.

⬤ The drop followed a long climb. During the previous two years Broadcom's value rose about 225 % moving from a little above $500 billion in early 2024 to above $1 trillion by the end of that year. The upward pace continued through 2025 and steady gains carried the firm to its December peak.

⬤ Although the stock wobbled in September and again in November, the December fall is the largest and fastest in recent months. The quick move from $1.95 trillion to $1.70 trillion shows how volatile prices become after long rallies, especially once a record high is reached.

⬤ The wider market feels the impact. When a company of this size swings so sharply in value, sentiment across the tech and semiconductor sectors shifts. The event underlines how fast conditions change after historic peaks, particularly when growth has been rapid for an extended stretch.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi