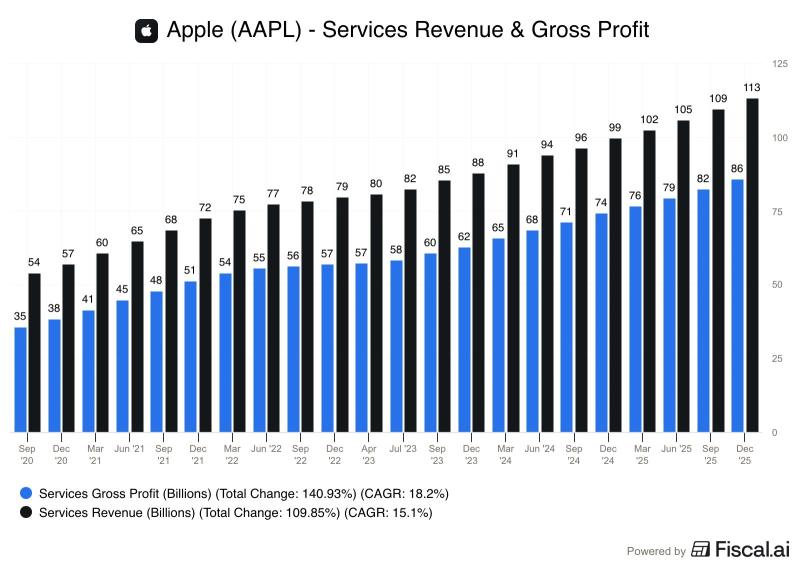

⬤ Apple's services business is on a roll. Revenue just hit $113 billion, and gross profit climbed to $86 billion — numbers that show just how central this segment has become to the company's bottom line. The data reveals a clear upward trend across multiple years, with services now acting as one of Apple's core money-makers.

⬤ The growth has been substantial. Services revenue roughly doubled from around $54 billion in late 2020 to $113 billion by late 2025 — that's about 110% total growth. Gross profit tells an even stronger story, jumping from roughly $35 billion to $86 billion, a gain of around 141%. The compound annual growth rate sits near 15% for revenue and closer to 18% for profit.

⬤ The gap between revenue and profit is widening — and that's a good thing for Apple. Services like subscriptions, digital content, payments, and software carry high margins and don't need the same manufacturing overhead as hardware. Even during slower periods elsewhere, this segment kept posting steady quarterly gains.

⬤ For the broader market, this shift matters. Apple is clearly moving toward recurring, high-margin revenue — which makes earnings more predictable and less dependent on device cycles. As services take up a bigger slice of total profits, they're reshaping how investors see Apple's long-term growth and competitive edge.

Usman Salis

Usman Salis

Usman Salis

Usman Salis