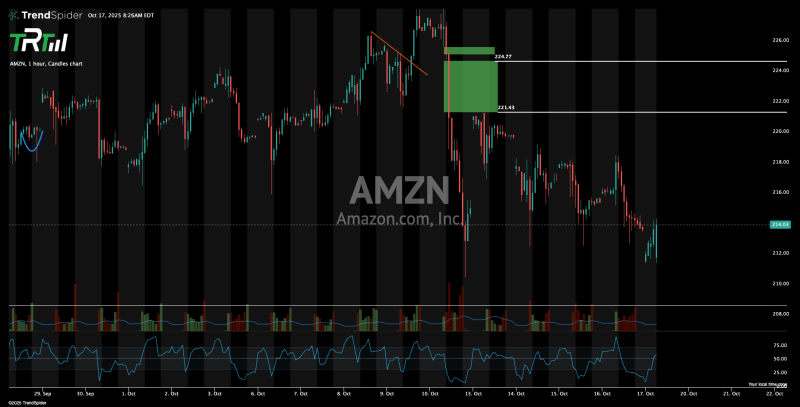

Amazon (AMZN) stock has experienced sharp swings recently, mirroring uncertainty across broader markets. Despite several intraday selloffs, the shares defended a higher low around $211, showing resilience during heightened volatility. Investors are now focused on whether this support level will hold and potentially fuel the next rally, or whether renewed selling pressure will push prices lower.

AMZN Price Action Analysis

According to John @ The Rock Trading Co., the week's choppy action may represent a support-building phase across the market. The chart reveals Amazon testing the $211 level before bouncing back toward $214, staying above the previous week's low. This area is emerging as a critical short-term floor for the stock.

The $210–$212 zone remains the key area that buyers continue to defend. On the upside, $221.43 and $224.77 represent significant resistance levels that need to be broken through for any sustained rally. Trading volume spiked during each selloff, yet rebounds showed consistent dip-buying interest. The RSI indicator briefly touched oversold territory before recovering, suggesting some near-term stabilization in momentum.

Broader Market Context

Amazon's recent volatility reflects patterns seen across large-cap technology stocks. With bond yields moving unpredictably and earnings season on the horizon, bulls and bears are locked in a tug-of-war. A break above $225 could trigger fresh upward momentum, while losing the $211 support might drag the stock toward $205 or lower.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov