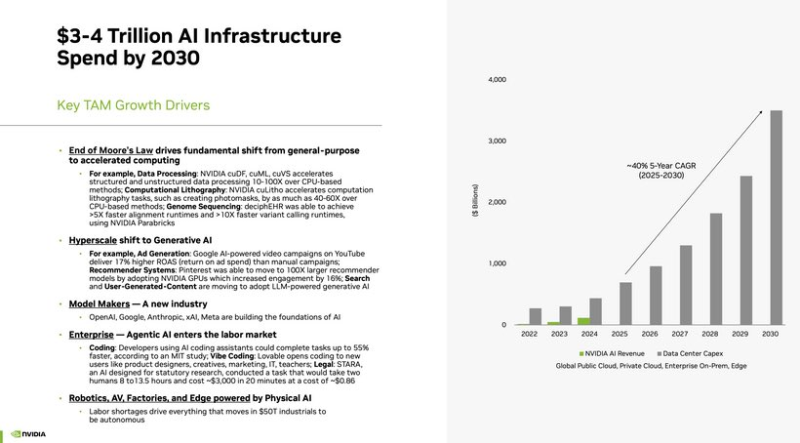

● In a recent analysis, Oguz O. | 𝕏 Capitalist highlighted AMD's massive opportunity in AI infrastructure. NVIDIA forecasts that global spending on data centers, edge computing, and AI systems will hit $3–4 trillion by 2030. While most investors watch NVIDIA, the argument is that AMD actually has more room to grow as it pushes into this expanding market.

● NVIDIA expects AI infrastructure investment to grow around 40% annually through 2030, driven by accelerated computing and generative AI demand. But this rapid growth comes with challenges — high capital costs, pricing pressure, and chip engineering talent shortages that could slow both production and innovation.

● Here's where the numbers get interesting. Oguz O. | 𝕏 Capitalist estimates that roughly one-quarter of total AI spending will go toward semiconductors — about $1 trillion. If AMD captures just 15% of that market, we're looking at $150 billion in annual revenue. Apply a 40% net margin and a 25× valuation multiple, and you land at a potential $1.2 trillion market cap. That's more than triple AMD's current valuation of around $375 billion.

● NVIDIA's own data shows data center capex will balloon alongside AI chip revenue as enterprises, governments, and cloud providers rush to upgrade infrastructure. The shift from traditional computing to AI-accelerated workloads is creating this trillion-dollar opportunity — and there's room for multiple winners.

Peter Smith

Peter Smith

Peter Smith

Peter Smith