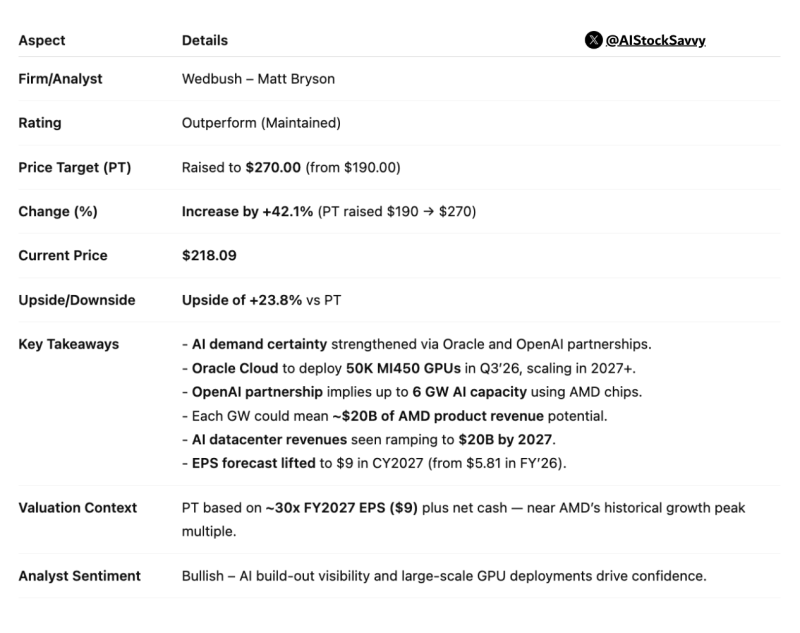

Advanced Micro Devices (NASDAQ: AMD) is riding a wave of bullish sentiment after Wedbush analyst Matt Bryson boosted the firm's price target from $190 to $270 while keeping an "Outperform" rating. The upgrade reflects AMD's expanding footprint in artificial intelligence, particularly through key partnerships with Oracle and OpenAI that are expected to drive substantial demand for its GPU and datacenter offerings.

Wedbush's Bullish Thesis

According to an update shared by Hardik Shah, Wedbush's optimism stems from several concrete developments. The firm now has greater confidence in AI demand certainty thanks to AMD's strategic alliances with Oracle and OpenAI. Oracle Cloud is planning to deploy 50,000 MI450 GPUs beginning in Q3 2026, with significant scaling anticipated in 2027 and beyond.

Meanwhile, the OpenAI partnership could power up to 6 gigawatts of AI capacity using AMD chips, with each gigawatt potentially generating roughly $20 billion in product revenue for AMD. Wedbush projects that AI datacenter revenues alone could hit $20 billion by 2027, driving earnings per share to around $9 in fiscal 2027, up sharply from $5.81 in fiscal 2026. The firm's valuation methodology applies approximately 30x to the 2027 EPS estimate plus net cash, a multiple that approaches AMD's historical peaks.

Market Performance and Technical Picture

AMD currently trades at $218.09, reflecting the market's positive response to the upgraded target. The $270 price target suggests about 24% upside from current levels.

The stock has established solid support around the $200 mark, which previously served as a consolidation zone during recent months. Immediate resistance sits just above $220, where recent rallies have encountered selling pressure. Trading volume has shown notable spikes lately, indicating that institutional investors may be building positions ahead of anticipated GPU demand growth.

The Investment Case

Several industry trends are fueling the bullish outlook for AMD. AI infrastructure needs are expanding rapidly, creating opportunities for AMD to compete more effectively with NVIDIA in the GPU market. Major cloud partnerships, especially Oracle's large-scale deployment plans and integration with OpenAI, position AMD squarely within the evolving AI ecosystem. The AI-driven datacenter segment is poised to become one of AMD's largest revenue streams by 2027. Upward revisions to earnings estimates by Wall Street analysts reflect growing confidence in the company's ability to execute on these opportunities and capture meaningful market share.

Looking Ahead

Wedbush's $270 target represents a vote of confidence in AMD's ability to capitalize on the AI boom. With Oracle preparing to roll out tens of thousands of GPUs and OpenAI potentially scaling to multi-gigawatt AI capacity, the revenue opportunity is substantial. If the stock can break through and hold above the $220 resistance level, the path toward Wedbush's ambitious target becomes more realistic. For investors watching the AI chip space, AMD's partnerships and product roadmap make it a compelling story worth following closely.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova