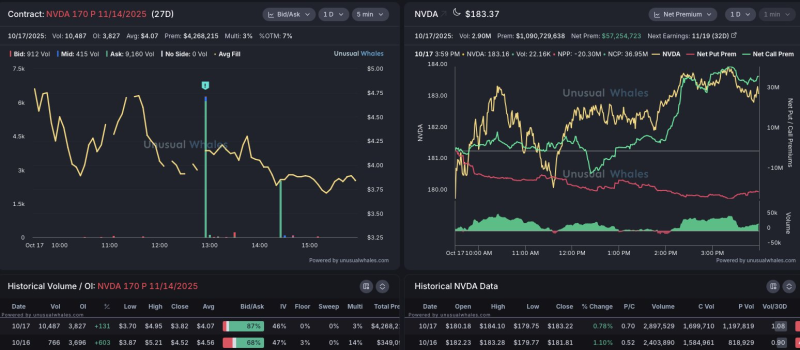

● Market analyst Salma recently pointed out some eye-catching bearish action on NVIDIA, tweeting about "really interesting volume on these $NVDA 170 puts being bought for 11/14 — bears spending $4.2 million on them & they closed in drawdown." According to Unusual Whales data, over 10,487 contracts changed hands on October 17, with open interest jumping to 3,827 at an average price of $4.07 per contract — totaling roughly $4.26 million in premium.

● What's driving this? Despite NVIDIA closing up 0.78% at $183.37, some traders are paying up to protect against a drop below $170. If the stock keeps climbing, these puts could expire worthless, leaving buyers nursing losses.

● This kind of heavy put-buying ahead of NVIDIA's November 19 earnings suggests institutional caution. While many investors still favor calls — net call premiums beat put premiums by over $57 million — the size of this bearish bet shows not everyone is convinced the rally will hold.

● NVIDIA remains a key gauge for AI and chip stocks. Even though bullish sentiment dominates, this $4.2 million position hints at underlying nervousness about valuations and macro risks heading into year-end.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah