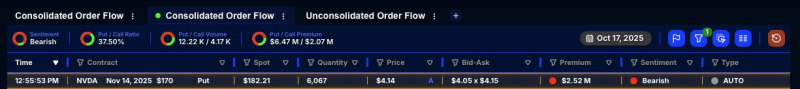

● Quant Data flagged a major bearish move on Nvidia ($NVDA), with a golden sweep worth $2.52 million aimed at the $170 strike for November 14, 2025. The trade covered over 6,000 contracts when the stock sat at $182.21, putting the put option roughly 6.7% out of the money. The bearish stance points to mounting worries about potential downside in the weeks ahead.

● Heavy bearish positioning highlights the risk facing high-value tech firms like Nvidia amid market swings and possible tax changes. Talk of tougher taxes on semiconductor and AI profits has sparked fears about squeezed margins, with some warning it could push talent away or strain operations.

● While policymakers see these measures as budget balancers, industry voices argue that raising profit taxes makes more sense than hitting innovation-focused sectors with broad levies. This approach could bring in revenue without disrupting strategic industries where Nvidia leads.

● The bearish bet also reflects jitters as fiscal shifts could reshape how companies contribute to the economy. If Nvidia's growth slows, it could hit employment, dent income tax revenue, and reduce corporate tax intake. Given Nvidia's central role in powering AI infrastructure globally, the stakes go well beyond one company's earnings.

● Nvidia stays at the center of tech investor attention, and this bearish sweep shows the tension between AI optimism and today's market caution.

Peter Smith

Peter Smith

Peter Smith

Peter Smith