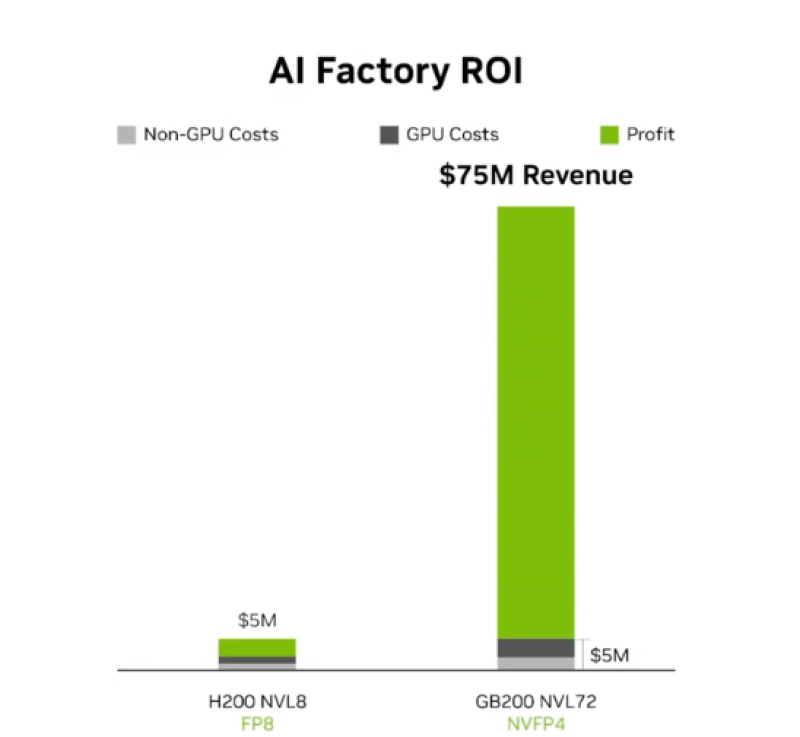

● NVIDIA recently revealed that its GB200 NVL72 system could generate $75 million in revenue from a $5 million AI factory investment—a 15x return that's reshaping expectations around AI infrastructure economics. The data, shared by Shay Boloor, shows that even after covering GPU and infrastructure costs, profits significantly outpace what's possible with previous-generation hardware like the H200 NVL8.

● What's driving this shift? The answer is straightforward: compute efficiency now directly translates to margin. When systems process workloads faster and more efficiently, operational costs drop while revenue potential climbs. For companies building AI services, this means the choice of hardware isn't just technical—it's financial strategy.

● But these economics are colliding with fiscal reality. As governments grapple with budget deficits, some are eyeing the tech sector's profitability for new revenue through tax reform. Proposals include adjustments to profit taxes and reconsidering VAT exemptions. The concern from the industry is equally clear: poorly structured tax increases could damage competitiveness, particularly for smaller software developers trying to compete with giants like NVIDIA.

● Industry voices have warned that aggressive tax measures without corresponding support for innovation could trigger "bankruptcies and mass relocation of specialists." The tension is real—while international AI infrastructure achieves remarkable profitability through hardware advances, domestic companies worry about being squeezed by rising costs just as global competition intensifies.

● NVIDIA's GB200 case shows how the economics of compute are forcing governments to make difficult choices: how do you fund public needs without crushing the innovation that drives future growth? It's a question that goes beyond tax rates—it's about whether policy can keep pace with technology.

Peter Smith

Peter Smith

Peter Smith

Peter Smith