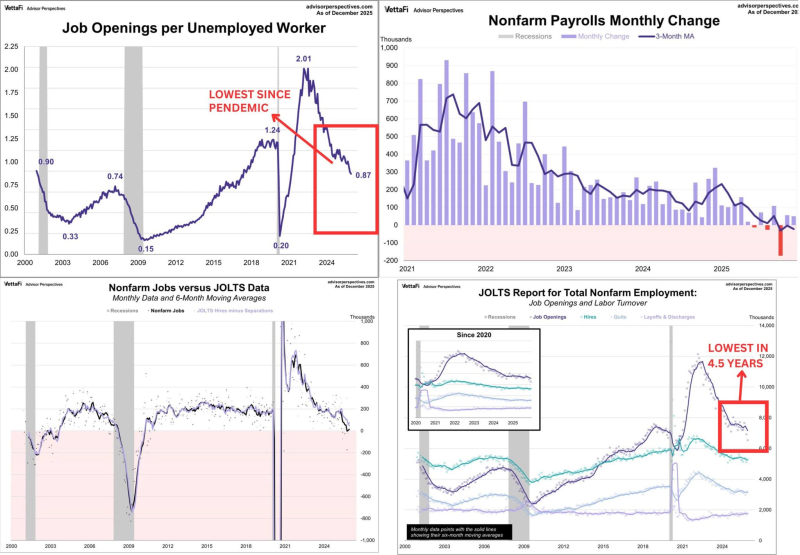

The U.S. labor market is showing clear signs of cooling as new data reveals declining job opportunities and softer hiring momentum. With job openings per unemployed worker dropping to post-pandemic lows and layoffs spreading across key industries, employers appear to be pulling back on workforce expansion. The trend marks a significant shift from the exceptionally tight labor conditions that defined the post-COVID recovery.

Job Openings Fall Below One Per Worker

Fresh labor market data paints a picture of broad cooling across the economy. The ratio of job openings to unemployed workers has plummeted to its lowest level since the pandemic, while hiring activity slows and layoffs hit transportation, technology, and healthcare sectors particularly hard.

The job openings ratio has dropped sharply from post-pandemic peaks, now hovering near levels where there's barely one available position per worker. JOLTS data confirms the trend with falling hires and shrinking openings, showing companies are hitting pause on expansion rather than adding capacity. This pattern aligns closely with observations about the U.S. job market weakening.

Payroll Growth Weakens as Hiring Slows

Nonfarm payroll changes tell a similar story. Monthly job additions have gradually weakened since 2022, with recent readings approaching flat levels compared to earlier expansion periods. The combination of slower hiring and rising layoffs points to a softer employment environment overall.

As one labor market analyst noted, We're seeing companies shift from aggressive hiring to cautious workforce management—the openings just aren't there like they were a year ago.

Broader sentiment reflects these concerns, with unemployment fears spiking as workers and economists alike brace for further cooling.

What This Means for the Labor Market

The data signals moderation rather than collapse. Declining openings, weaker payroll growth, and reduced hiring together illustrate a cooling employment cycle. The labor market is clearly moving away from the exceptionally tight conditions seen in previous years, though it hasn't tipped into crisis territory yet. Still, the trajectory suggests continued softness ahead as companies adjust to changing economic conditions.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah