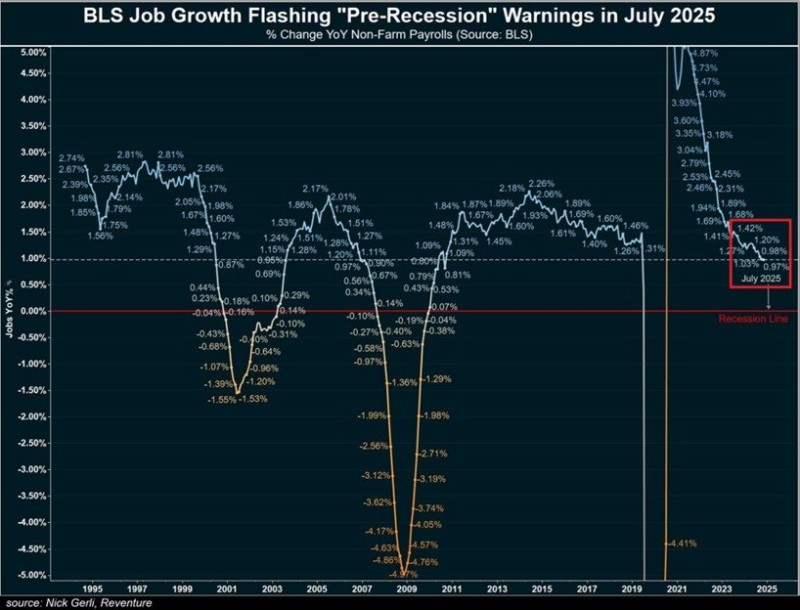

The U.S. labor market is flashing warning signals. Recent Bureau of Labor Statistics data shows job growth in July 2025 declined to just 1.20% year-over-year—a threshold that has historically preceded economic downturns. While optimism persists among many investors, the numbers tell a more cautious story.

Payroll Growth Mirrors Historical Downturns

According to analysis shared by REtipster with Seth Williams, when payroll growth dips toward the 1% mark, recessions have often followed.

Looking at the pattern, job growth fell below 1.5% before the 2001 dot-com crash, dropped under 1% ahead of the 2007-2009 financial crisis, and collapsed during the 2020 pandemic shock. Now in 2025, non-farm payroll growth has slipped again, raising familiar concerns. This recurring pattern suggests employment trends remain one of the more reliable economic warning signals available.

What's Driving the Slowdown

Corporate caution is evident as businesses pull back on hiring amid tighter credit and consumer uncertainty. Technology shifts, particularly the adoption of AI and automation, are reducing demand for certain job categories. The Federal Reserve's rate hikes continue working their way through the economy, while sectors like manufacturing, retail, and transport are underperforming. Services show a mixed picture, but overall momentum has clearly weakened.

Market and Economic Implications

Weak payroll growth directly affects consumer spending, which drives much of the U.S. economy. Past downturns at similar levels have brought stock market volatility, falling Treasury yields, and increased interest in safe-haven assets like gold. If the trend continues, recession fears could intensify, putting pressure on equities while making defensive strategies more attractive.

Peter Smith

Peter Smith

Peter Smith

Peter Smith