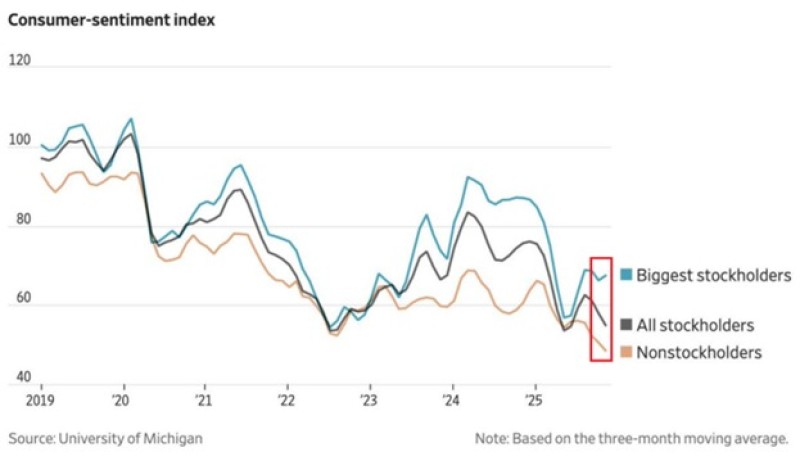

⬤ U.S. consumer sentiment is splitting down the middle based on who owns stocks and who doesn't. Recent University of Michigan data shows that sentiment among non-stockholders has dropped to its lowest level since tracking began in 1998, while the biggest stockholders have seen their confidence improve by roughly 10 points in recent months. This is happening as the S&P 500 trades near all-time highs, raising questions about growing economic inequality.

⬤ The data tracks three groups: biggest stockholders, all stockholders, and non-stockholders. Over recent months, sentiment for big stockholders has climbed near yearly highs, while non-stockholders have seen an almost mirror-image decline of about 10 points. The gap between these groups has now stretched to roughly 20 points—the widest it's been since late 2024. The divide reflects mounting anxiety among lower-income households, especially as job market concerns hit levels not seen since the 1980s.

⬤ While stockholders have benefited from rising equity prices, non-stockholders seem increasingly pressured by weaker economic expectations and financial strain. The stock market boom clearly hasn't translated into better confidence for households without market exposure. This divergence matters because it signals uneven economic resilience—and that can affect spending behavior, political attitudes, and growth expectations going forward. With the S&P 500 at record levels and job worries intensifying, there's a growing disconnect between Wall Street and Main Street.

Usman Salis

Usman Salis

Usman Salis

Usman Salis