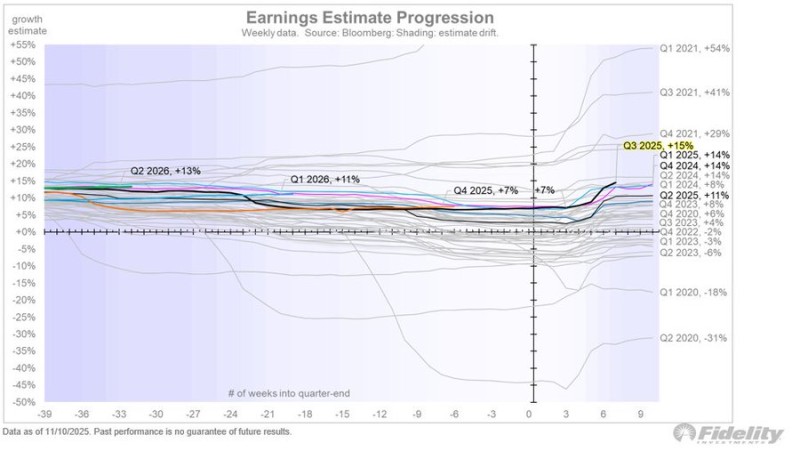

⬤ Markets are getting a boost from earnings that are coming in well above expectations. The S&P 500's Q3 earnings growth started the quarter at 7% but has now jumped to 15%—a 700-basis-point improvement that's well above the typical revision pattern. This momentum has carried through the last three quarters and is lifting sentiment heading into year-end.

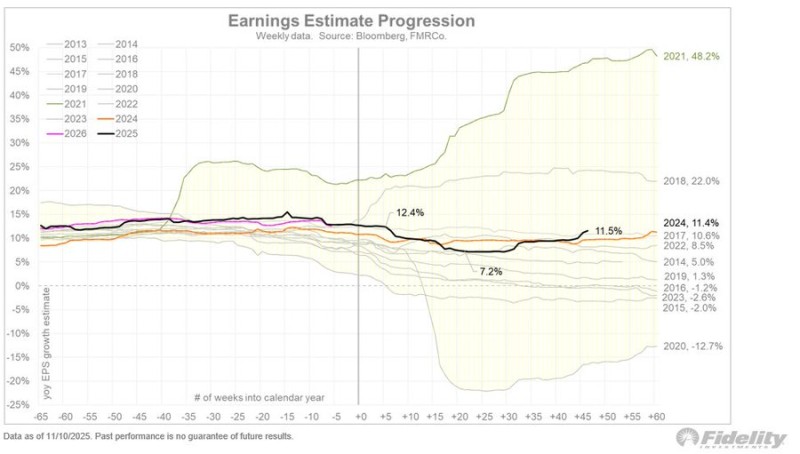

⬤ The earnings charts tell the story clearly. Q3 2025 is now showing +15% growth, significantly better than initial forecasts. Meanwhile, the full calendar-year 2025 estimate sits at 11.5%—nearly back to where it started the year and higher than 2024's finish. It's rare for full-year estimates to accelerate mid-year like this unless the economy is climbing out of a downturn, which makes the current trend noteworthy.

⬤ Historical context helps put this in perspective. While 2021 saw massive earnings growth of +48.2% during the post-pandemic rebound, the current 11.5% trajectory is solid and stands out compared to recent years when estimate revisions typically drifted downward. The upward momentum in Q3 has reinforced the broader earnings picture for 2025.

⬤ For investors, this matters because stronger earnings support market valuations and sentiment. With Q3 delivering 15% growth and full-year forecasts holding steady at 11.5%, the market's foundation looks more solid—as long as these earnings trends continue.

Usman Salis

Usman Salis

Usman Salis

Usman Salis