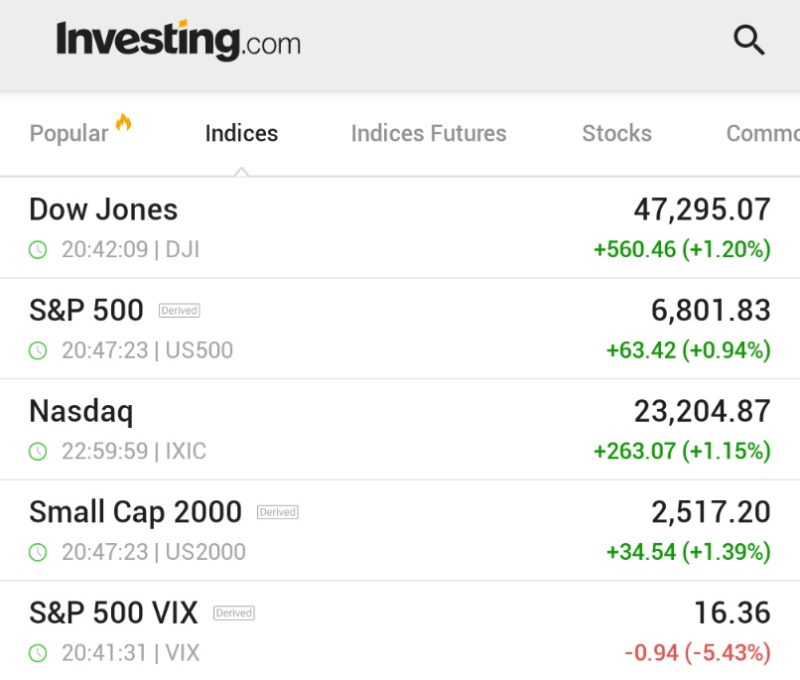

● According to a market update from Investing.com, all three major U.S. indexes closed at record highs on Friday after inflation data came in softer than expected, breathing new life into hopes for Fed rate cuts. The Dow Jones jumped 560 points (+1.20%) to close at 47,295, the S&P 500 gained 63 points (+0.94%) to reach 6,801, and the Nasdaq climbed 263 points (+1.15%), capping off what's shaping up to be a stellar year-end rally.

● What's driving this? The market seems increasingly convinced that inflation is cooling off quickly enough to justify rate cuts as early as 2026. But here's the catch—analysts are warning that stocks might be getting ahead of themselves. Valuations are stretched, and if inflation decides to flare up again, the Fed could hit pause on any easing plans. That would almost certainly trigger some turbulence, especially in tech stocks, which are particularly sensitive to interest rate moves.

● The numbers tell an impressive story. Friday's surge alone added roughly $1.2 trillion to the overall equity market cap. Meanwhile, the VIX—Wall Street's fear gauge—dropped 5.43% to 16.36, showing that investors are feeling a lot more comfortable right now. Money's been flowing out of defensive plays and into growth sectors, with AI, semiconductors, and financials leading the charge. Still, some portfolio managers are raising eyebrows at how fast sentiment has shifted, warning that markets could be setting themselves up for a fall if upcoming CPI or jobs data comes in hotter than expected.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah