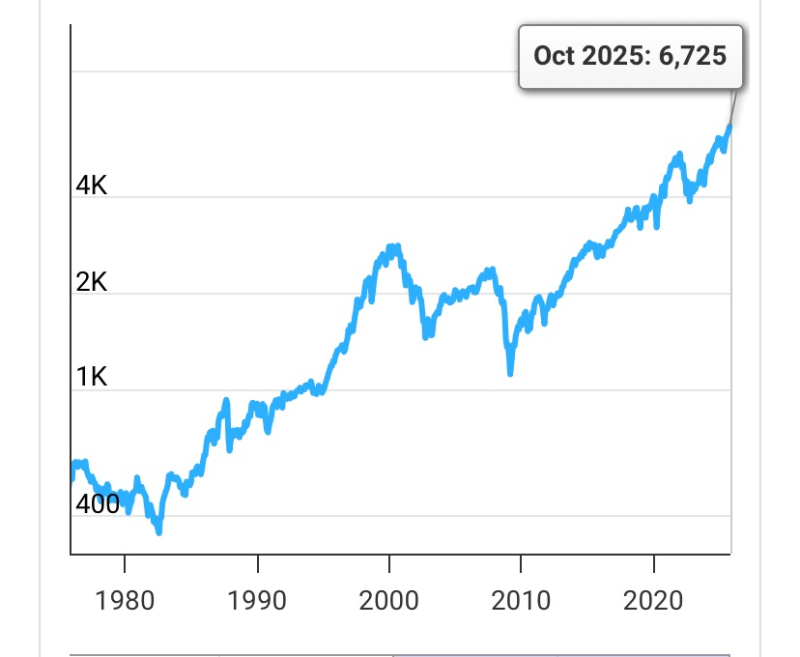

● The Money Cruncher, CPA recently shared a chart showing the S&P 500's inflation-adjusted performance over five decades—from the late 1970s through October 2025, when it hit 6,725 points. The takeaway? Markets reward patience.

● Despite major crashes—the dot-com bubble, 2008 financial crisis, and COVID-19 pandemic—the index's long-term trajectory kept climbing. Short-term dips are normal, but panicking during downturns usually backfires. Investors who sell during crashes miss the recovery gains.

● As The Money Cruncher puts it: "This chart is inflation adjusted S&P 500 returns (no dividends) over the last 50 years. This is exactly why having a long-term mindset is crucial. Short-term drops are inevitable."

● The data shows that equity investors consistently outperformed those sitting in bonds or savings accounts. While diversification helps manage risk, the real lesson is simple: stay invested. Market timing rarely works, and patience remains the best hedge against volatility.

● After 50 years of economic turbulence, the message is clear—compounding growth and discipline trump emotional reactions every time.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah