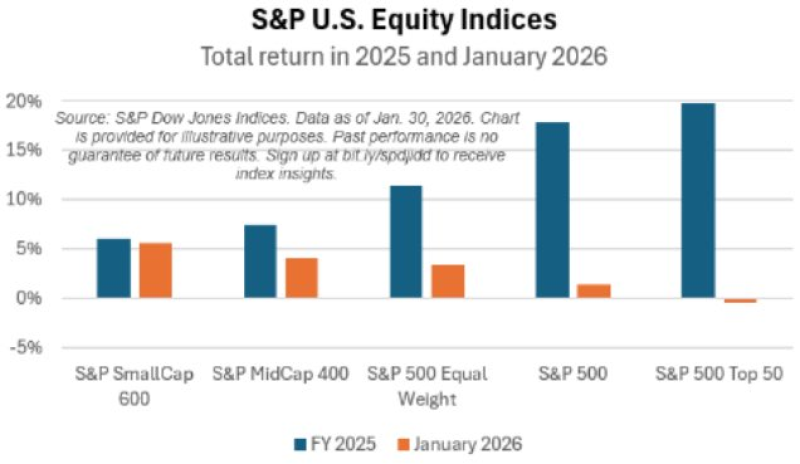

⬤ U.S. equities wrapped up January on a positive note, but the real story was where those gains came from. After a year dominated by mega-cap tech names, smaller companies finally started pulling their weight. Mid- and small-caps stepped up while the market's biggest players took a breather, pointing to a healthier spread of returns across the board.

⬤ The numbers tell the story clearly. The S&P SmallCap 600 and S&P MidCap 400 both posted gains for the month, leaving larger-cap benchmarks in the dust. Even the S&P 500 Equal Weight index—which treats every stock the same regardless of size—beat the traditional market-cap-weighted S&P 500. That's a signal that it wasn't just the usual suspects driving returns this time around.

⬤ Meanwhile, the S&P 500 Top 50 actually dropped about 0.5% in January, making it the worst performer of the bunch. These mega-caps had crushed it throughout 2025, but January showed investors rotating their money elsewhere. The biggest names that carried the market last year suddenly found themselves on the sidelines as capital flowed into the stocks that had been left behind.

⬤ Why does this matter? Because when more stocks participate in a rally, it typically means a healthier market with less concentration risk. If mid- and small-caps keep this momentum going, it could reshape how investors think about portfolio allocation and where the next wave of returns might come from. January's rotation suggests the market might be setting up for a more balanced year ahead, with leadership spreading beyond just a handful of dominant players.

Usman Salis

Usman Salis

Usman Salis

Usman Salis