⬤ Momentum in US stocks is getting seriously stretched right now. Goldman Sachs' high beta momentum long basket has had a strong run to kick off the year — up around 20% year to date. Here's the thing: over the past 20 trading sessions alone, it's outperformed the S&P 500 by nearly 24 percentage points. That kind of gap doesn't happen often.

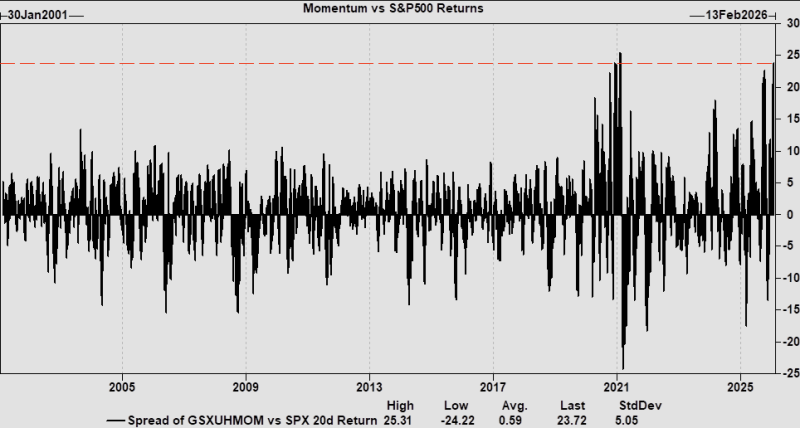

⬤ To put this in perspective, the spread between momentum returns and the S&P 500 has been tracked all the way back to 2001. For most of that stretch, it hovers close to zero. Right now? It's sitting at roughly 23.7 — compared to a long-term average near 0.6. That places the current move among the largest outperformances on record.

⬤ Spikes of this magnitude have only shown up during a handful of past episodes — think 2021, when the market was heavily concentrated in high beta, momentum-driven names. Back then, a narrow group of stocks pulled far ahead of the broader index, and the current setup mirrors that kind of extreme. The underlying conditions may be different this time, but the scale of the divergence is remarkably similar.

⬤ So why does this matter? When momentum baskets get this far ahead of the S&P 500, it usually signals that traders are piling into a narrow slice of the market pretty aggressively. Large spreads like this tend to come alongside higher dispersion and shifting risk dynamics. As the gap approaches prior highs, the real question is whether momentum can keep running — or whether a snapback toward the broader index reshapes volatility and sentiment across US equities.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova