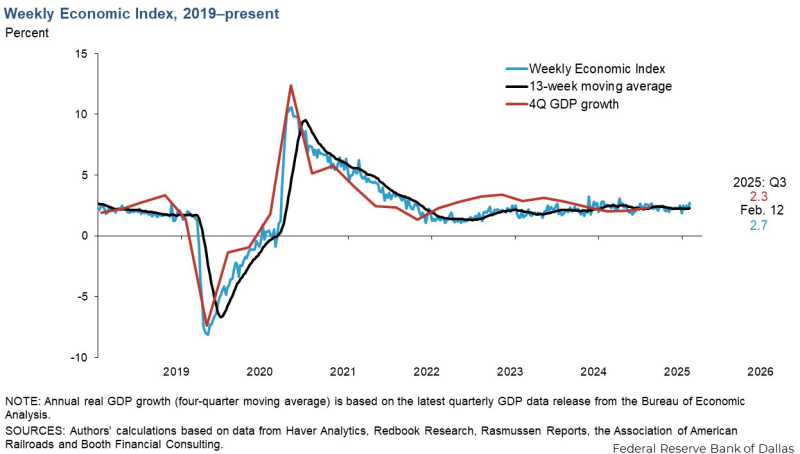

⬤ The Dallas Fed Weekly Economic Index posted a solid gain last week, climbing to 2.70% for the period ended February 7—up from 2.21% the week before. The 13-week moving average also ticked higher to 2.31%, reinforcing the picture of steady expansion in the U.S. economy. For investors watching macro-sensitive assets like the S&P 500, this update offers a fresh read on growth momentum between the big quarterly releases.

⬤ What makes this index useful is its focus on weekly data, giving traders a real-time pulse on economic activity rather than waiting months for official GDP figures. The latest reading fits comfortably within the recent trend, which has held in a relatively narrow band between 2% and 3%. Meanwhile, annual real GDP growth sits around the low-2% range, with the most recent four-quarter moving average near 2.3%. So we're not seeing a dramatic acceleration here—just continued growth at a moderate clip.

The index rose to 2.70% for the week ended Feb 7, compared with 2.21% for Jan 31, while the 13-week moving average increased to 2.31%.

⬤ The smoothed 13-week average helps filter out weekly noise, and right now it's showing stabilization after some earlier choppiness. That stability matters because sudden shifts in high-frequency indicators can quickly reshape market sentiment around growth-sensitive positions. Recent developments like U.S. GDP Growth Forecast Lifts Market Mood, Sparks Rally in S&P 500 Futures show how growth signals can move markets, and this week's index reading keeps that constructive tone intact. For broader fiscal context, the US Fiscal Deficit Drops 17% in First Four Months of FY26 adds another piece to the macro puzzle.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi