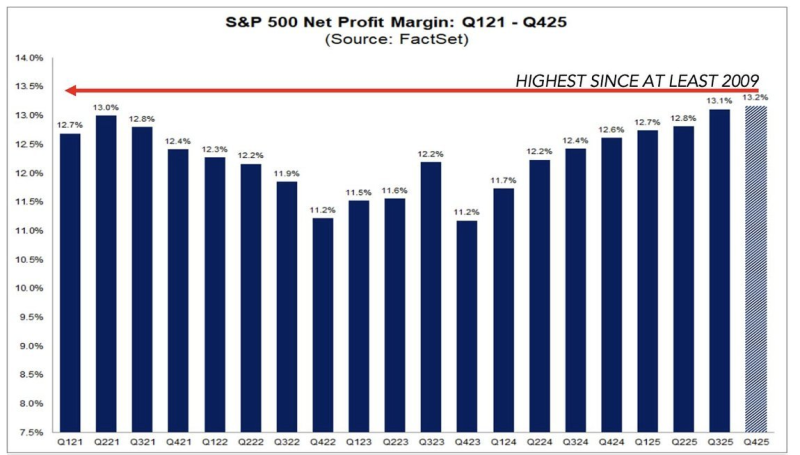

⬤ S&P 500 companies just hit a major profitability milestone – net profit margins are now at levels we haven't seen since at least 2009. According to FactSet data, aggregate margins have been climbing steadily through recent quarters, hitting around 13.2% in Q4 2025. That's the highest point on record for this period, easily surpassing the previous post-financial-crisis peaks.

⬤ The numbers tell an interesting story about corporate resilience. After margins peaked near 13.0% in mid-2021, they took a hit during 2022, dropping to around 11.2% by late that year and early 2023. But from that low point, we've seen a steady recovery – margins pushed back above 12% in 2024 and kept accelerating throughout 2025.

⬤ What makes this particularly notable is that it wasn't just one strong quarter. The data shows consistent improvement across multiple reporting periods: from roughly 12.2% in Q3 2024 to 12.6% in Q4 2024, then continuing upward through 2025 – hitting 12.8% in Q2, 13.1% in Q3, and finally 13.2% in Q4.

⬤ This performance is especially impressive when you consider the headwinds companies have been facing – concerns about growth, rising costs, and general economic uncertainty. Yet S&P 500 firms have managed to maintain pricing power and operational efficiency strong enough to push margins to new cycle highs.

⬤ For investors, this matters because profit margins are one of the main drivers of earnings growth and stock valuations. When margins stay elevated like this, it shapes how the market views corporate strength, earnings sustainability, and overall U.S. equity performance going forward.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova