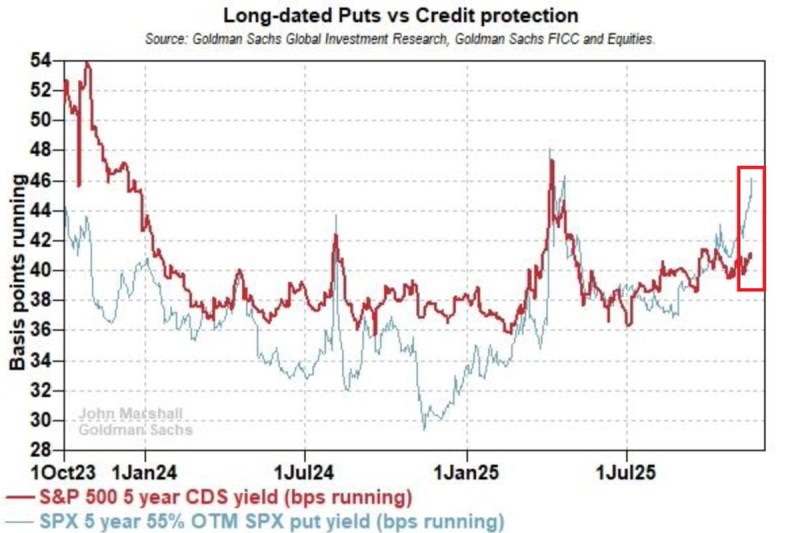

⬤ The cost of protecting against a fall in the S&P 500 has jumped as investors rush to buy long term insurance against a severe drop. A five year put that pays out if the index falls 55 % now costs 46 basis points, the most since April's rout. The chart shows the yield on such a contract climbing steeply in recent days.

⬤ Apart from April, this is the highest price in at least two years, a sign that fear is spreading through the equity market. The red line for five year S&P 500 credit default swaps has also risen, but the move in puts is sharper. Goldman Sachs reports that the dollar amount of options and credit protection traded last week set a record underscoring heavy demand for hedges.

This is the highest level in at least two years reinforcing the view that investor fear is spreading through the equity market.

⬤ The spike follows months of uneven equity returns and shows that traders now focus on rare but severe risks. The chart segment shows put prices moving above their prior range, a signal that investors favor long dated protection over short term volatility bets. Credit swap levels have increased - yet the steeper rise in put yields reveals a targeted concern about equity losses.

⬤ Heavy demand for long dated protection matters because it steers risk appetite plus positioning across the market. High hedge costs shape expectations for future volatility and alter how funds size their large cap equity holdings. If demand for hedges keeps rising, the pattern may shift option market dynamics and broader equity sentiment before the next macro but also earnings releases.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova