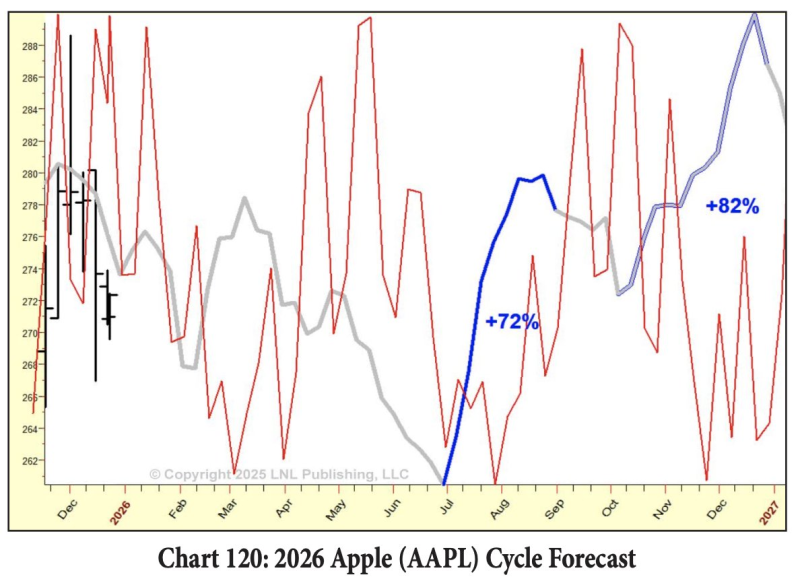

⬤ Apple (AAPL) is getting attention from a fresh cycle-based forecast that sees considerable volatility ahead in 2026—but still predicts a strong upside trend as the year unfolds. The analysis from renowned trader Larry Williams acknowledges near-term fluctuations but maintains that the broader cycle pattern points to materially higher prices for Apple shares during 2026. The forecast chart shows early-year weakness giving way to powerful upward momentum starting around midyear.

⬤ The cycle model doesn't sugarcoat the volatility—it shows clear swings in projected price behavior throughout the year. But the blue forecast line tells an optimistic story: a sharp rebound from midsummer levels, with a projected move of roughly 72% from the cycle low into late summer. The momentum doesn't stop there. A final upward push near year-end shows potential gains of approximately 82% from earlier projected lows, revealing a fundamentally bullish structural outlook despite shorter-term choppiness.

⬤ The accompanying analysis suggests that if Apple's historical market rhythms align with this projected pattern, it could lift the entire tech sector. This isn't meant as a quick trading signal—it's a long-horizon view of how cyclical forces might shape AAPL's path through 2026. The chart layers daily price bars with cycle projections, creating a visual contrast between near-term volatility and the longer-term directional trend.

⬤ Why traders should care: Apple drives major stock indices, so AAPL expectations influence sentiment across the entire tech sector. A cycle forecast showing higher prices despite volatility suggests long-term market forces remain supportive of large-cap tech performance in 2026. The projected swings also serve as a reminder that periods of pressure and uncertainty will likely coexist with the upward trend.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah