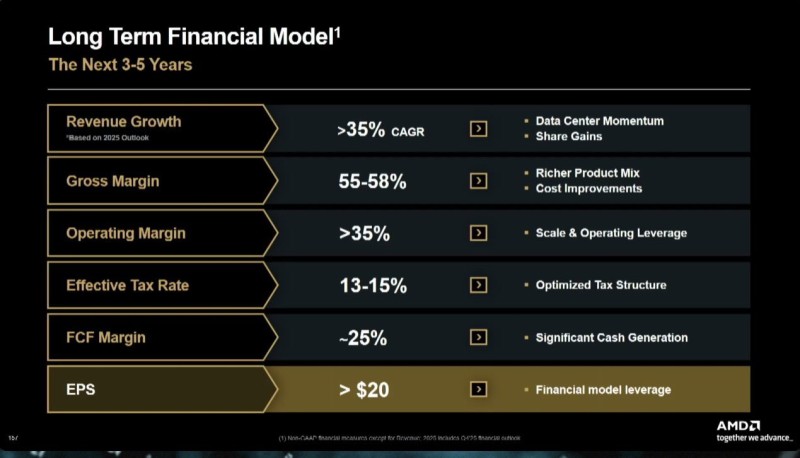

⬤ Advanced Micro Devices has rolled out a bold long-term financial plan that's turning heads in the semiconductor space. The company is eyeing more than 35% compound annual revenue growth over the next three to five years, with earnings per share expected to climb above $20. The guidance points to serious momentum in data center operations, where AMD is actively grabbing market share with a stronger product lineup. What's particularly interesting is that based on these 2030 EPS projections, AMD's current valuation works out to roughly 11 times expected earnings—a compelling multiple for this kind of growth story.

⬤ The financial framework AMD laid out shows gross margins landing between 55% and 58%, driven by a richer product mix and better cost management. Operating margins are projected to push past 35% as the company scales up and squeezes more efficiency from its operations. The tax structure looks optimized too, with an effective rate between 13% and 15%. Free cash flow margins are modeled at around 25%, which translates to substantial cash generation as the business expands.

⬤ The long-term targets reflect AMD's confidence in its data center trajectory and its ability to capture share across key markets. The revenue growth target north of 35% annually isn't just about volume—it's backed by product mix improvements and operational discipline. The EPS projection above $20 showcases what AMD calls financial model leverage, where expanding revenue combined with tight cost controls drives stronger bottom-line results. The company is clearly betting on its competitive positioning in high-performance computing and AI infrastructure to fuel this growth.

⬤ This outlook matters because semiconductors sit at the heart of major tech trends like artificial intelligence, cloud buildouts, and advanced computing. By putting out concrete long-term targets with rising margins and strong cash flow, AMD is making a statement about where it stands competitively and how deep its demand pipeline runs. The forecast reinforces the broader industry narrative that companies with leading technology and smart product strategies can deliver sustained growth and expanding profitability over the long haul.

Peter Smith

Peter Smith

Peter Smith

Peter Smith