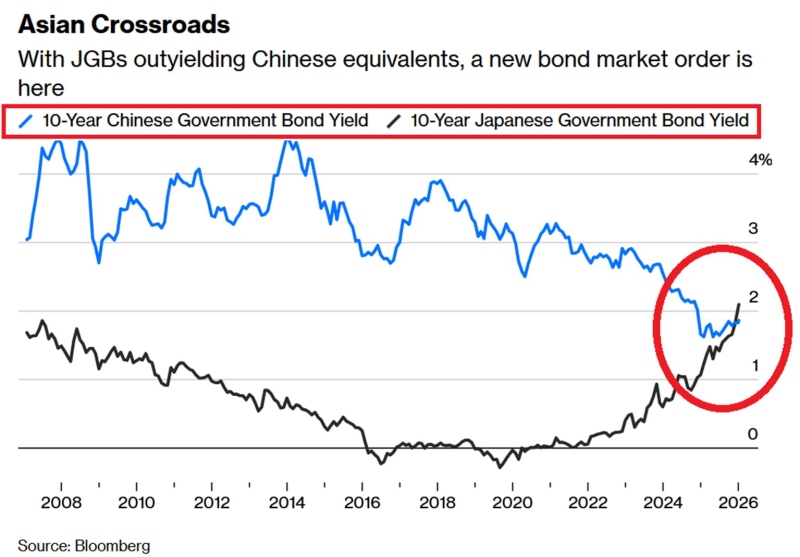

⬤ Japanese government bond markets just hit a historic turning point. Ten-year JGB yields have overtaken Chinese government bond yields after trailing behind for more than 15 years. The crossover is stark: Japanese yields are climbing fast while Chinese yields keep sliding lower. This reversal upends Asia's bond market pecking order, where China had long been seen as the region's dominant growth engine commanding consistently higher sovereign yields.

⬤ The numbers tell the story of Japan's dramatic shift. Ten-year JGB yields have rocketed from around -0.28% in 2019 to roughly 2.10% in early 2026—their highest level since 1999. This surge follows the Bank of Japan's major policy U-turn, raising interest rates to a 30-year high with hints that more tightening could be coming. Meanwhile, Japan's government is opening the spending taps with a record Fiscal Year 2026 budget that includes unprecedented military spending.

⬤ China's bond market is moving in the opposite direction. The 10-year Chinese yield has dropped from about 3.05% to roughly 1.86%, hovering near historical lows. The decline reflects a struggling economy: slowing growth, rising deflation fears, and continued trouble in the property sector. The People's Bank of China keeps easing monetary policy to prop things up, which only pushes yields lower and widens the gap between Chinese and Japanese bonds.

Usman Salis

Usman Salis

Usman Salis

Usman Salis