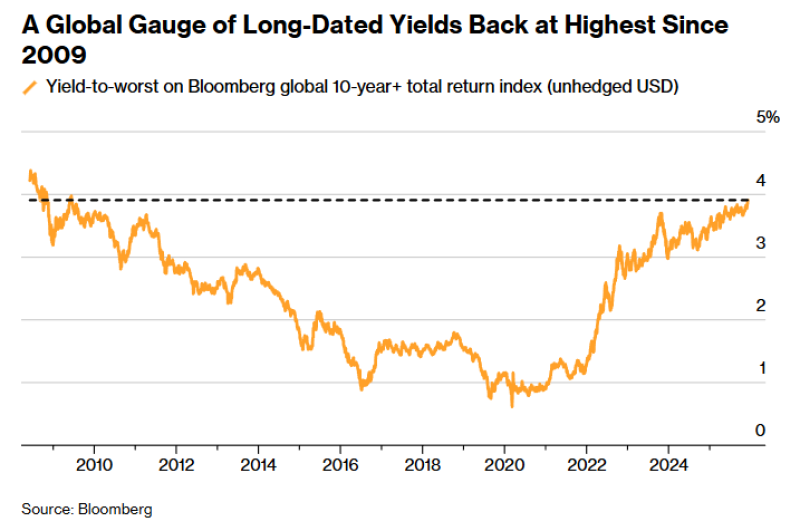

⬤ Long-dated bond yields across global markets have jumped to their highest point since 2009. The Bloomberg Global 10-year-plus total return index shows yields approaching 4 percent, hitting levels that haven't been seen in over fifteen years. This shift is changing how investors think about traditional safe havens, with gold getting a fresh look as bonds lose their defensive appeal.

⬤ The numbers tell a clear story. After the financial crisis, long-dated yields dropped steadily for more than a decade, bottoming out between 2019 and 2021. Since then, they've reversed course sharply, with the most dramatic moves starting in 2022. Bond prices have weakened as yields climb, tightening financial conditions worldwide.

⬤ What makes this significant is that government bonds have long been the go-to defensive play during uncertain times. That's changing now. Inflation pressures, government spending patterns, and tighter monetary policy are all reshaping how these markets behave, and precious metals are benefiting from the shift.

⬤ Rising global yields matter because they affect everything from borrowing costs to how assets are valued. When bonds lose price stability, investors start looking for other stores of value. With yields now at 2009 levels, the relationship between fixed income and precious metals like gold is becoming a key driver of market sentiment and positioning.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova