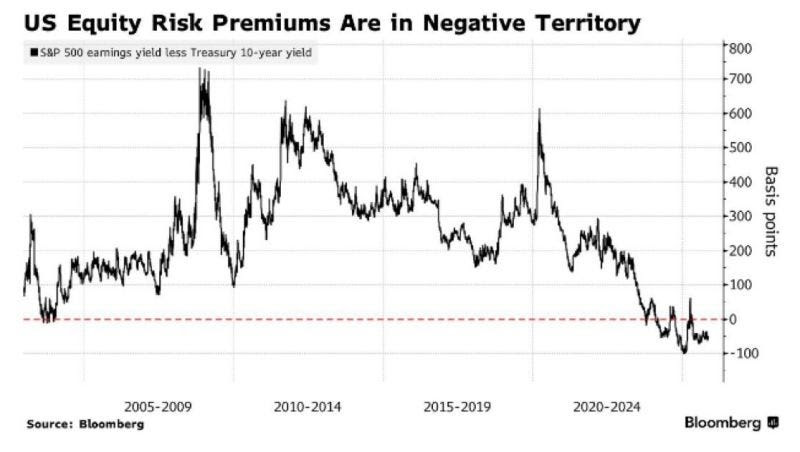

⬤ The S&P 500 has entered unusual territory—its equity risk premium just turned negative. According to recent Bloomberg, the index's earnings yield now sits below what you'd get from a 10-year Treasury bond. That flips the normal script where stocks are supposed to pay you more for taking on extra risk.

⬤ The numbers tell an interesting story. When the equity risk premium hovers around these levels, the S&P 500 has historically delivered only 2-3% returns over the next year. That's a far cry from the nearly 10% average annual return investors have come to expect. The chart tracking this spread shows we've only seen similar setups a handful of times in the past two decades—briefly in 2021 and right before the 2008 financial crisis.

⬤ As one market observer noted, "When bonds match or exceed equity yields, the entire risk-reward equation changes across asset classes."

⬤ This shift happens when valuations run hot, bond yields climb, or corporate earnings can't keep pace with economic growth. Right now, with Treasury yields still elevated, the gap between risk-free government bonds and stock earnings has essentially disappeared. That's raising questions about whether equities can justify their current price levels.

⬤ The implications are straightforward—when safe bonds pay as much as stocks, money tends to flow toward the safer bet. For the S&P 500 to maintain its momentum from here, we'll need to see either earnings growth accelerate or interest rates come back down. Until one of those things happens, the market's dealing with a yield disadvantage that could weigh on sentiment and valuations.

Peter Smith

Peter Smith

Peter Smith

Peter Smith