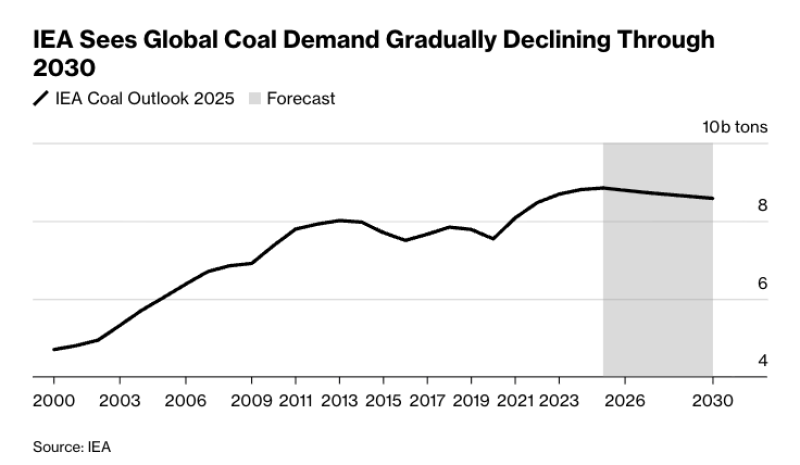

⬤ The world's appetite for coal is about to hit a ceiling. The International Energy Agency's latest numbers show global coal demand climbing by 0.5 percent this year to reach an all-time high of 8,845 million tons. But here's the thing—that's the peak. From there, it's downhill as cleaner energy options start eating into coal's market share.

⬤ The IEA's Coal Outlook 2025 paints a pretty clear picture: coal consumption has been on a steady climb since 2000, reaching its zenith in the mid-2020s. Looking ahead to 2030, the agency expects demand to slide about 3 percent below today's levels. What's driving this shift? Mostly renewable energy projects coming online and more liquefied natural gas becoming available, both of which are pushing coal out of power plants around the world.

⬤ But the transition isn't happening evenly everywhere. In the United States, coal burning is actually expected to jump 8 percent in 2025, bucking the global trend. This uptick has more to do with short-term factors like fuel prices and how utilities are juggling their power generation mix, not a retreat from long-term climate goals. Meanwhile, most other regions are seeing coal demand either flatten out or drop as they ramp up renewable installations and secure better access to natural gas.

⬤ Why does this matter? Coal still powers a huge chunk of the world's electricity and industrial operations. A peak followed by gradual decline could reshape everything from energy prices to trade patterns to where companies decide to invest their money. The fact that US coal use is heading in the opposite direction shows just how bumpy and region-specific the energy transition really is—this shift away from coal is going to be a slow burn, not a sudden switch.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets